A wine lover businessman purchased lovely Bordeaux wines years ago for $20. The wine’s value was greatly appreciated with time, so much that it would fetch $300 if sold in an auction. But this man refused to sell the bottle and instead, kept it in his wine rack. All because he was attached to the item and found it too valuable to let go.

It’s a similar case with house owners. They tend to overvalue their homes while selling them but are not ready to purchase a new of the same kind at that price.

Richard Thaler called this pattern – people demanding much more to sell their object than they are willing to acquire the new one – The endowment effect.

What Is The Endowment Effect?

The endowment effect in psychology and behavioural economics refers to an emotional bias theory in which people overvalue their belongings, often irrationally or higher than the actual market value.

In simple terms, people tend to place a higher value on something that is already in their possession and overvalue it, over an identical item for sale. This phenomenon involves a role of the psychological inertia theory of “no-change” where people tend to stick with the status quo instead of making a change unless they are provided with a substantial incentive.

For example, if a person offers a child to exchange their favourite toy with a new toy, chances are they will not exchange it and will instead choose to keep their favourite toy.

This phenomenon of the endowment effect is also known as “Mind over Market Value” or the “psychology of ownership“.

Endowment Effect Psychology

A person’s perceived product value = Market Value + Emotional Value

The endowment effect comes into existence when an object has an emotional backstory or a symbolic significance to an individual. This attachment results in an emotional value of the product which adds to its market value.

Thus, the new value gets equivalent to the combination of the product and emotional values – which results in an overestimation of an object’s value.

For instance, a person may even want to pay $500 to get his wallet back which originally had $100. Just because the wallet was a gift from his late mother.

Psychologically speaking, two concepts closely relate to and influence the endowment effect –

- Status quo bias, and

- Loss aversion.

Status Quo Bias

Status Quo Bias is an emotional bias that prevents a person from undertaking any action to change the current or previous state of affairs.

For example, a person watching Netflix may keep watching that show just because he doesn’t want to stand up and pick up the remote.

When the status quo bias gets amalgamated with ownership, it becomes a primary stimulus resulting in the endowment effect. For example, a person owning an iPhone wants to be in the league of iPhones, as switching to android would require the person to give up the exclusive feeling of being an Apple user.

Loss Aversion

Loss aversion refers to a cognitive bias phenomenon in which people focus on avoiding losses more than on acquiring equivalent gains.

For instance, an individual receives a job offer that pays him $100 if he does it, but he pays $35 if he fails to do it. Chances are he will decline the offer because, more than being happy about earning $100, he is afraid of losing $35.

Similarly, if a person invested in a stock, losing 2% of the invested amount will cause more anguish than gaining the same percentage.

Applications Of Endowment Effect In Marketing

With changing marketing trends, marketers increasingly use psychological and economic factors to drive conversions. The endowment effect is one such factor which marketers use to increase sales.

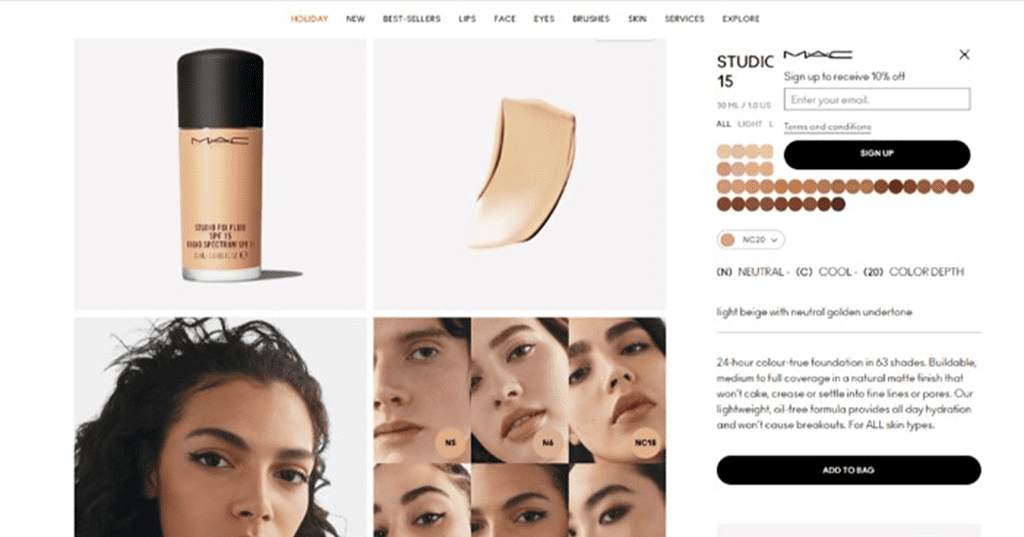

Haptic Imagery

Haptic imagery is a cognitive process where people mentally experience an object’s physical properties without actually touching or feeling them.

For instance, if an author asks the readers to imagine touching a feather, the haptic imagery will activate a sense of softness in their minds.

Product descriptions, images, videos, and other visual elements used in marketing are often designed to evoke a haptic response from the audience.

For example, Mac shows 63 shaded foundations and illustrates each shade using a model of different skin tones. This makes it easier for a customer to choose the correct shade for her skin tone as she can imagine what the product will feel like on her skin. Just this thought triggers an emotional connection with the product, making her more likely to buy it.

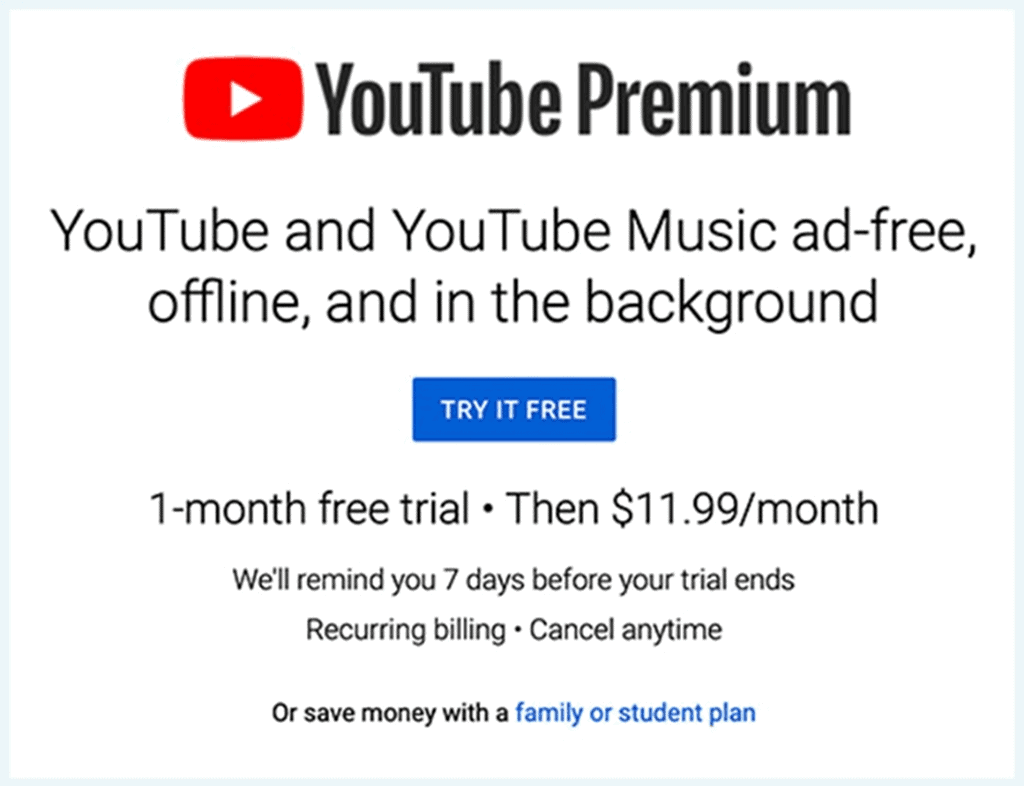

Free Trials

Free trial is an acquisition model that offers a product or service to customers free of charge for a limited time before the customer purchases it.

It revolves around a strategy that giving the chance to customers to use the products before paying for them will kick-start the endowment effect.

The endowment effect is the reason why car companies offer test drives, and YouTube offers 30-day free trial. The longer time people spend customising and using the product, the greater the sense of ownership gets, and the harder it is to give up.

Free Return Policy

The free return policy allows customers to return the purchased product to the retailer free of cost under certain policies drafted by the company.

A study on Return Policy and the Endowment Effect shows that customers face a harder time returning the purchased product as they start to value the object more once they own it.

And that is a proven fact because statistics show that though 79% of customers want a return policy, only 30% of them choose to return products ordered online.

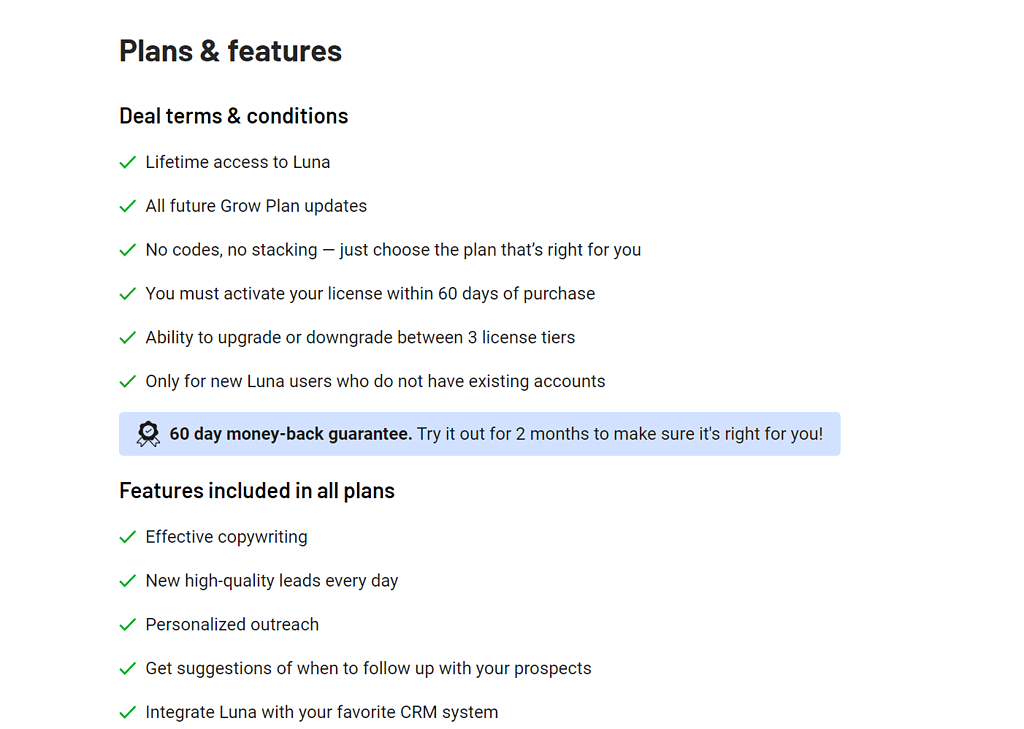

Freemium Versions

Freemium is a portmanteau of the words “free” and “premium”. It is a strategy in which a company offers basic or limited features in the free version of the product or service and charges money for advanced features or an upgrade.

In Spotify’s free version, users can skip ads and use the shuffle feature while listening to songs – basic features with ads. But with Spotify premium, users can download songs, listen to uninterrupted music, share playlists with friends, and get more features.

The endowment effect plays an important role in the success of freemium models. People are more likely to upgrade to a better version if they have already used the free version and grown accustomed to it. It is easier for them to part with their money if they have experienced the product or service first – even if it was simply a limited experience.

Virtual Visualisation/Virtual AR

Virtual Visualisation or Virtual AR bridges the gap between the digital world and the physical world by providing users with an enhanced experience. It allows customers to view products in 3D, interact with them as if they were in a physical store and gain a more realistic understanding of what the product looks like and functions.

For example, Lenskart’s virtual AR allows users to scan and analyse their faces, detect the face shape and temple size, and then recommend frame shapes that will suit them best. It also allows users to try 1000s of looks in just a few clicks.

This strategy serves as an emotional trigger that leads to a feeling of ownership and endowment effect, thus influencing purchasing behaviour.

Amazon lets customers virtually fit furniture in their house before they buy it. This provides the customers with a tangible simulation of how furniture would look in their home, allowing them to make an informed decision. This strategy again can be seen as an application of the endowment effect.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of our article on endowment effect in the comments section.

Ravpreet is an avid writer, prone to penning compelling content that hits the right chord. A startup enthusiast, Ravpreet has written content about startups for over three years and helped them succeed. You can also find her cooking, making singing videos, or walking on quiet streets in her free time.