The invoice is a significant financial document that every business gets and needs to manage. That’s why every business needs to have an effective system in place for managing their invoices, which would streamline the entire invoicing process.

As businesses evolve, more and more invoices are generated. The increased number of invoices that must be tracked, verified, and processed can quickly become overwhelming for businesses. This is proven by a survey done by Sapio Research and Wax Digital in 2018, which found that 82% of finance departments feel overwhelmed by the number of invoices they must process daily and the formats they come in.

This highlights a critical need for efficient invoice management, simplifying the entire invoicing process.

What is Invoice Management?

Invoice Management is a business-organised method of tracking and paying all its bills.

It is just like a traffic conductor, guiding the rush hour flow of invoices through business, ensuring nothing is lost in transit or paid late.

It’s an important process within a business’s financial management, enabling them to maintain an organised and clear record of their expenditures.

Invoice management can become quite a burden as a business grows, even though it might initially seem simple. As the business expands, so does the volume of invoices, making invoice management increasingly burdensome.

Why Is Invoice Management Important?

All information related to purchases and buying is being streamlined by invoice management. It makes a comprehensive, go-to database that captures everything from purchase orders and payables to transactional details.

Listed below are a few reasons why invoice management is essential.

- Ensures Timely Payments – Proper invoice management ensures vendors, suppliers, and contractors are paid on time. This increases goodwill and leads to faster delivery times and enhances their willingness to correct defects.

- Smooth Cash Flow Management – Expert invoice management helps in efficient cash flow management. With precise tracking of incoming and outgoing payments, businesses can maintain optimal cash flow and avoid potential financial crunches.

- Financial Accuracy – An effective invoice management system helps companies record all transactions, preventing missed or double payments and providing accurate financial metrics.

- Complete Overview of Purchase Patterns and Behavior – Using an efficient invoice management system gives businesses a thorough understanding of their purchasing trends and behaviour. Making informed choices about cost optimisation, supplier relationships, and inventory management is possible with the help of this important data.

- Efficient Tax Management – Some of the invoicing software includes features such as sales tax reports, which outline the tax accrued from sales and the input tax from purchases, assisting in accurate tax management.

What Does An Invoice Management Process Involve?

The steps involved in the invoice management process are as follows:

- Invoice Receipt – The process begins with the receipt of the invoice from the supplier or service provider. This can be received through various means, such as post, email, or electronic transfer.

- Invoice Verification – Following receipt, the invoice needs to be verified for accuracy. The amount, date, supplier details, and item descriptions listed on the invoice are checked against the original purchase order and delivery note.

- Approval of Invoice – Once verified, the invoice is then approved for payment. Approvals may need to be sought from various individuals within the organisation, depending on the value and nature of the invoice.

- Record Invoice – The invoice is recorded in the organisation’s accounting system to ensure financial accuracy. Recording the information correctly is crucial for tax purposes and for ensuring accurate financial reporting.

- Payment Process – Payments are then processed within the stipulated time to maintain good supplier relationships and avoid late payment fees. Businesses may set up automated payment processes for recurring invoices to ensure no payment is missed.

- Record of Payment – Keeping a record of all made payments is important for any discrepancies that might arise later. It also assists in analysing the cash flows into and out of the business.

- Audit and Review – Regular audits and reviews of the invoice management process ensure that the system is functioning optimally and helps identify improvement areas.

Challenges Involved In Invoice Management

Large companies receive hundreds of purchase invoices each month, and it is not possible to manage invoices in bulk because each invoice needs to be verified and examined separately.

Therefore, a lot of invoice management challenges arise:

- Poor Accounting Systems – One primary challenge often arises from the use of inadequate accounting systems that may not effectively handle all the complexities of the invoicing process.

- Slow Processing – It takes a lot of time and effort to process invoices manually. Delays in processing can lead to delayed payments, affecting vendor relationships and potentially accruing late payment penalties.

- Missing Invoices or Data – Missing invoices or crucial data can lead to financial reporting and budgeting errors.

- Error-prone Procedures – With manual procedures, the potential for human error increases. Inaccuracies in data entry and procedure can result in incorrect invoice processing.

- Labor-intensive Processes – Prior to approval, each invoice needs to be examined, verified, and balanced against other bills. For large businesses, processing a single invoice can take weeks. Manual inputting, coding, and verifying invoices can be extremely time-consuming and labour-intensive.

- Cash Flow Visibility – Managing numerous invoices from various vendors can be confusing. Certain vendors may send you invoices after the deadline, even if you have paid all of your bills on time.

Receiving multiple bills for the same purchase could be another issue. You might have to pay twice for a purchase. This adds to the difficulty of recovering the extra money back.

Such inefficient invoice management can impact cash flow visibility, affecting cash management and financial planning.

Therefore, dealing with these challenges through automation and invoice management solutions becomes crucial to improving business efficiency.

Main Ways To Effectively Manage Invoices

The two main ways in which invoices are being managed:

- Manual invoice management

- Automated invoice management

Manual Invoice Management

Manual invoice management is the traditional method of handling invoices. It involves physical storage of invoices, manual entry of data into accounting systems, and person-to-person approval processes.

Manual handling of invoices can lead to a lot of discrepancies. Research indicates that when invoices are managed manually, approximately 12.5% of them may necessitate some form of reprocessing due to errors or discrepancies, and only 17.5% are paid on time.

So, It is not advisable for large businesses that handle hundreds of invoices at once to use this outdated method.

Pros

- Direct Control and Inspection: You can physically review each document and check for errors personally, potentially catching any discrepancies right at the outset.

- No Upfront Technology Investment: There’s no need to spend on expensive software or training. Manual invoicing has barely any investment costs besides regular office supplies and storage equipment, which might be ideal for small businesses or startups.

Cons

- Time-Consuming: It can be a lengthy and tedious process to manually handle each invoice. The time spent reading, recording, and approving each piece restrains productivity that could be channelled into more strategic tasks.

- Higher Error Rate: The risk for human error in data entry and lost invoices is higher. Additionally, physical documents can get lost or damaged, creating a potential challenge in tracking.

- Slower Processing: Manual procedures delay the invoice approval process, which can strain supplier relationships. Delays could crop up during peak business times, leading to late payments, aggravated suppliers, and potentially affect partnerships negatively.

- Late Payments: Heavy fines for late payments may add up to a significant financial loss for the business.

Automated Invoice Management

Automated invoice management incorporates technology to streamline the invoicing process. This includes electronic invoice storage, automatic data entry, and digitally enhanced workflows for approvals.

It allows timely and efficient payments by precisely extracting and verifying payment details. An automated invoice management system effectively eliminates the laborious and repetitive processes involved in manual invoice management.

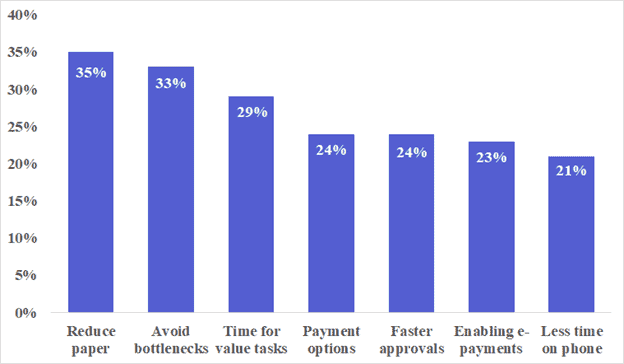

According to a 2021 survey on The How, The Why, and The ROI of AP Automation, businesses wish to automate their invoice management processes for the following reasons:

Pros

- Efficiency: Automation significantly speeds up the invoice processing time. It could turn the hours spent on manual entry into mere minutes, allowing staff to be more productive and tackle higher-value tasks.

- Reduced Errors: The automatic data entry helps reduce human errors by minimising miscalculations and enhancing financial transactions’ overall precision.

- Real-Time Tracking: It provides instant, real-time insight into your payables. Critical financial insights are at fingertips, enabling businesses to make timely decisions and strategise effectively.

- Cost Reduction: It can reduce costs in the long run by reducing manual labour, improving payment timings to avoid late fees, and improving cash flow management.

Cons

- Initial Investment: There is a cost for purchasing and deploying the software.

- Adaptation and Training: Switching from a manual system to an automated one signifies a change in process. Employees must learn how to use the new system, which can also add to the initial investment.

- Dependence on Tech Support: With digital systems, the risk of technical glitches or system breakdowns exists. Any technical faults require immediate attention, causing dependency on technical support.

Manual vs Automated Invoice Management

Absolutely, here is a more in-depth side-by-side comparison in the form of a table for Manual vs Automated Invoice Management:

Criteria | Manual Invoice Management | Automated Invoice Management |

|---|---|---|

Process | Traditional method of handling invoices, involving physical storage, manual data entry, and person-to-person approval process. | Use of technology to streamline the invoicing process, including electronic storage, automatic data entry, and digitised workflow for approvals. |

Efficiency | Slower process due to reliance on human speed and availability. More prone to delays especially if the invoice volume is high. | High efficiency because of the speed of computers and software. Reduces time spent on data entry and approval processes substantially. |

Error Rate | High error rate due to the possibility of manual typos, misplacements or lost invoices. | Low error rate as most tasks are automated thereby eliminating human error. |

Cost | Lower initial cost but high long-term due to continued need for staff hours, storage space, and potential for late payments or overpayments due to errors. | High initial costs of software procurement and deployment but cheaper in the long run due to reduction in man hours, prevention of late payment penalties and overpayments. |

Real-Time Tracking | Tracking is difficult and time-consuming due to physical records. | Instant, real-time tracking of invoices is possible, providing greater visibility into finances. |

Scalability | As the business grows, the challenges of a manual system may become insurmountable due to increment in volume, higher errors and increased costs. | Automation scales better with growing business needs and can manage large volumes of data with ease. |

Audit & Compliance | Since manual systems lack structured data and are more vulnerable to lost or misplaced invoices, compliance can be challenging. Audit trails might not be kept up to date. | Clear audit trails and structured data make compliance enforcement easier. |

Transition Of Automated Invoice Management Systems

Technological advancements and changing business models have significantly impacted the evolution of invoice management processes over the years. Traditionally, businesses handled invoices through a largely manual procedure, often leading to inaccuracies, time delays, and reduced efficiency.

Up until recently, automated invoicing management was not an advanced procedure. Automation of workflows through artificial intelligence and machine learning are fairly new concepts.

Invoice Factoring

A financial solution such as Invoice factoring is used in invoice management to improve a business’s cash flow. It involves selling outstanding invoices to a factoring company, also known as a factor, to receive immediate cash instead of waiting for clients to pay the invoices.

Invoice factoring plays an integral role in invoice management, enabling businesses to receive immediate cash flow without waiting for customer payments, which can typically take between 30 to 90 days.

Benefits Of Invoice Factoring

Adopting invoice factoring within a company’s invoice management process can drastically enhance their financial stability and operational efficiency. A few benefits are listed below:

- Improved cash flow: The primary benefit of invoice factoring is improved cash flow. By selling their invoices to a factor, businesses can receive an immediate advance, often between 70% and 90% of the total invoice value, enabling them to meet immediate financial demands.

- Effectively managing the working capital: It allows businesses to pay their employees, buy necessary resources, invest in growth opportunities, or meet other financial obligations without waiting for their clients to pay their invoices.

- Reduce the collection time: Invoice factoring can significantly reduce the collection time and effort involved in invoice management because the responsibility of collecting the outstanding receivables shifts to the factoring company. The factor then carries out the task of chasing customers for invoice payments, allowing the business to focus on its core operations.

Moreover, factors can provide businesses with resources and services often reserved for larger firms, such as thorough credit checks on potential customers. This ability can prove invaluable for small businesses with limited resources.

Bottom Line

In the current technology-intensive business landscape, efficient invoice management is pivotal for ensuring smooth financial operations. As businesses continue to grow and scale, Invoice management solutions are now a need rather than a luxury for companies looking to run their finances accurately and efficiently.

Processing invoices manually can result in a variety of issues such as late payments,slow processing, etc, which could be easily solved by adopting effective invoice management solutions coupled with intelligent features like automation and factoring services.

FAQs

An invoice management system is a tool or software that automates the process of managing and tracking invoices. It helps businesses create and send invoices, follow-up on unpaid bills, keep a record of financial transactions, and generate financial reports.

Key features to look for include invoice creation and customisation, automated invoicing, invoice tracking, payment reminders, access to various payment methods, security measures, reporting capabilities, and integration with other essential tools or software your business uses.

AI can significantly improve the efficiency of invoice management. AI-powered invoice processing can handle large volumes of invoices, reduce manual effort, minimise errors, and speed up the entire process. AI can also help identify patterns in data and make predictions for future transactions.

Invoice factoring is a financial transaction where a business sells its outstanding invoices to a third-party company, or factor, at a discount. This practice can help improve both cash flow and the efficiency of invoice management as the factoring company takes on the responsibility of collecting invoice payments, allowing the business to focus on other operations.

Wordsmith. Caffeine enthusiast. A full-time business-oriented writer with a knack for turning the ordinary into extraordinary. When not working, you can find Ishan listening to music, reading or playing with doggos.