Today, we can’t deny that startups have found a special space in the business ecosystem. They have become such an important part that our daily vocabulary is now full of startup-related words like venture capital, seed funding, venture capitalists, aggregator, etc.

The point is, people assume that everyone understand these startup lingos…which is not the case most of the times.

If you found this article on a search engine, chances are that you’ve encountered venture capital in any of your conversations but never fully understood the core concepts behind it, how it is different from angel investment, and who exactly is a venture capitalist, etc.

Well, here’s a guide answering all your questions.

What is Venture Capital?

Venture Capital is the funding investors provide to the high-growth potential startups in exchange for equity in the company.

In a simple context, venture capital is provided to startups (not any new company) which are growing at a remarkable rate and are in need of money to sustain that growth. The investor, in return, demands equity or an ownership stake in the company.

An example of this exchange would be a venture capitalist providing $100,000 to help the startup grow and in return taking a 10% stake in the company.

What Is A Venture Capitalist?

A venture capitalist is a professional investor (usually a firm) that funds startups and business ventures showing high growth potential in exchange for an equity stake.

Venture capitalists are usually formed as limited partnerships where the partners invest in the VC funds. These partners are usually categorized into two types – the Limited Partners (LPs) and General Partners (GPs).

The limited partners are institutional investors which provide money to the fund, like university endowments, pension funds, insurance companies and other big corporates and high net-worth individuals.

The general partners (GPs) are active investors who make the decisions on where, how, and how much to invest. They are usually industry veterans with business, research, and entrepreneurial experiences who have a sound knowledge of their niche and the startup ecosystem.

Since their money is on the stake, VCs also provide guidance and direction to the companies they invest in and take an active part in the decision-making process too.

However, contrary to the usual belief, VCs don’t usually fund companies that have just started. As a matter of fact, less than 1% of companies receive venture capital. Moreover, raising venture capital is a lengthy and stressful process and involves a lot of examinations from the investors’ side.

But entrepreneurs still go to the VCs. Why, you ask?

Why Do VCs Exist?

A question that must have crossed your mind is why do VCs exist? Can’t startups go to the banks or financial institutions to fund their ideas and early-stage companies?

Well…they can’t.

Venture capital’s niche exists because banks are not willing to take risks funding early-stage startups (of which 9 out of 10 fail). Even if they do, they do it with high interest rates and only to the extent of the hard assets against which they can secure the loan.

Now, SBA loans do exist. But while they might be good for small businesses, startups often require a lot of funding as they plan to disrupt the whole industry.

This need resulted in an all-new niche where people (angel investors), corporates, and even financial institutions invest money in promising ventures, help them grow, and make profits by exiting with most profits.

How Venture Capital Works?

Startups raise venture capital in instalments known as venture rounds. These venture rounds sum up the types of venture capital that exists.

- Pre-Seed Funding: It is required to validate the product hypothesis and build an MVP. Usually, not much investment is required at this stage and almost no venture capitalist invest during the pre-seed funding phase unless it’s one of their partners’ venture.

- Seed Funding: Once the hypothesis related to the product-market fit is validated, entrepreneurs look for seed funding. This investment is used to set-up the company, build the actual product, and start full-fledged operations. Most venture capitalists stay away from seed funding as most of the financial needs of the companies at this stage (usually between $500,000 and $2 million) are met by fundings from angel investors (high-net-worth individuals) or banks. Moreover, they don’t invest in companies during the seed stage as startups have a high risk of failing during this stage.

- Series A-F: Once the startup starts receiving traction in the form of the number of users, revenue, views, or other KPIs, it becomes ready to raise a series A funding to grow and expand. This is where most of the venture capitalists come in. Series A round is followed by 5 more rounds. However, according to CB Insights, only 48% of the companies go for a second round of the funding (after the seed round), and only 15% of the companies go for a Series C round.

According to HBR, around 80% of the venture capital goes into the infrastructure required to grow the startup. This includes expense investments (manufacturing, marketing, and sales) and the balance sheet (providing fixed assets and working capital).

Even though venture capital is an important investment for the startups, it really isn’t a long-term investment from the venture capitalist’s point of view. Their plan is to invest in the company’s growth until the time it reaches sufficient size and is credible enough to be sold to a corporation or any other party.

In simple terms, they buy a stake, nurture it till it becomes profitable, and exit it as soon as they can.

Venture Capital Process

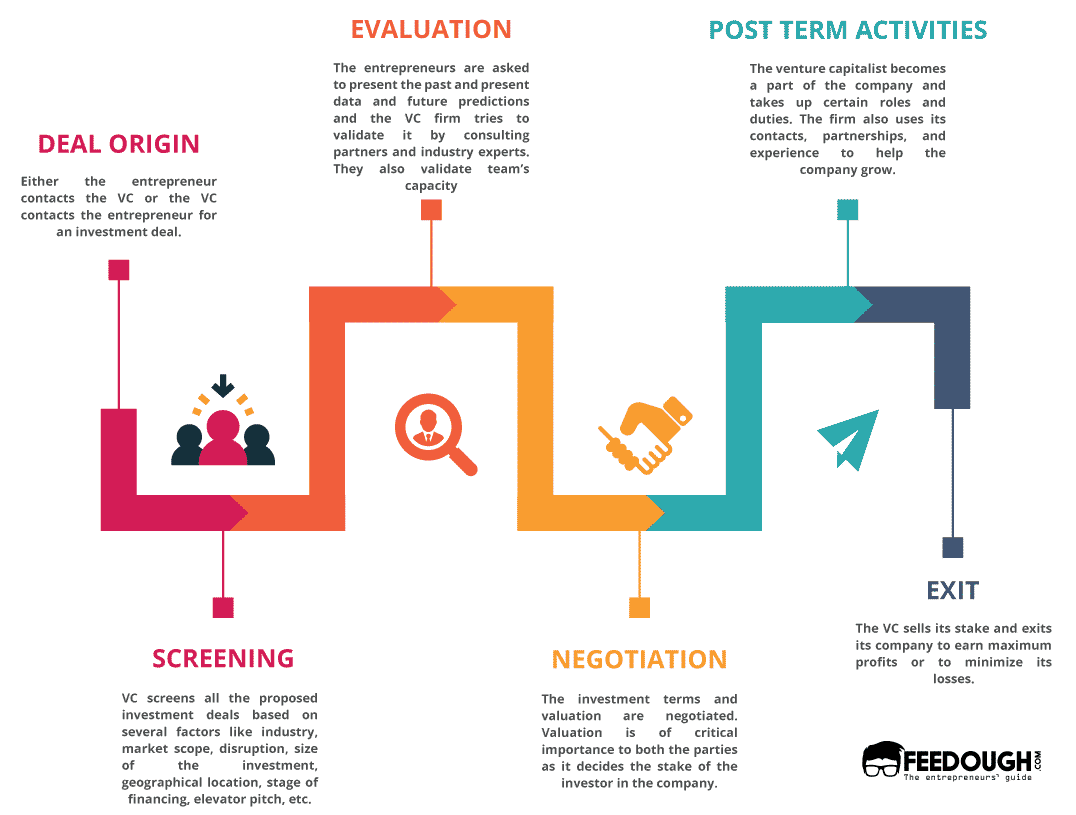

While the venture capital process is very complex and works a bit differently for different VC firms, we’ve tried to break it down into six steps which start with them getting the offer to invest and end with them exiting the company.

Deal Origination

An investment deal can originate in various ways. Either the entrepreneur contacts the firm directly, or the partners get to witness the startup in competitions, meetups, news, or become a customer themselves; or the deal can originate in the form of a referral by business partners, parent organisations, friends etc.

Screening

This stage involves the screening of all the proposed investment deals. The projects are screened based on several factors like industry, market scope, disruption, size of the investment, geographical location, stage of financing, elevator pitch, etc.

The most promising projects reach the next stage which involves a more detailed evaluation.

Evaluation

Once the potential projects are chosen from the lot, the evaluation begins.

This stage involves a lot of effort from both the parties. The entrepreneurs are asked to present the past and present data and future predictions and the VC firm tries to validate it by consulting partners and industry experts.

In the evaluation stage, the VCs not only evaluate the product’s capacity but also the team’s capacity to meet the proposed claims. The project passes this stage only if they feel that the goals are attainable and the team has relevant skills, competence, ability, and experience to make it happen.

Risk management is also done to evaluate the ROI by keeping the forecasted risks alongside.

Terms & Valuation Negotiation

Once the evaluation is complete, the investment terms and valuation are negotiated. Valuation is of critical importance to both the parties as it decides the stake of the investor in the company.

Valuation is divided into two segments – pre-money valuation and post-money valuation. The pre-money valuation is the agreed-on value of the company before the investment is made and post-money valuation is the valuation after the investment is made.

Suppose the parties agree on a (pre-money) valuation of $40M and the investor pitches in $20M, the post-money valuation will be $60 million and the investor’s stake in the company will be 1/3 or 33.34%, at the closing of the financing.

There’s no one right formula to decide the valuation of the company and both the parties have their say during the negotiation. The entrepreneur tries to keep the valuation as high as possible while the investor tries to keep it low to have a higher stake.

The valuation along with other terms are included in a term sheet developed by the VC. Here are some other elements that are included in the term sheet–

- Option Pools: It’s a pool of stocks reserved for employees or future employees of the startup.

- Liquidation Preference: It is a kind of safety net for the investors which gives them preference to get some money back in the case of the startup failing. In simple terms, at the time of the liquidation, the investors or other preferred stockholders get back up to a percentage (usually 100% or 1x) of the amount they invested in the company before any other common stockholder gets anything. Of course, no one gets anything if all the money is lost.

- Participation Rights: Participating right or participating preferred favours the investors more. It is a type of liquidation preference where the investor gets 1x of his investment back but also gets his proportional share of any cash that remains after that. For example, say a venture capitalist with preferred stock has $1M liquidation preference with participation rights and owns 20% of the cap table. Suppose the company sells for $10M. He gets back the $1M as his preferred stock as well as the 20% of the remaining $9M, which comes out to be $1.8M, because he had participation rights. This leaves $6.2M to be divided between common shareholders and the founders.

- Dividends: The terms related to dividends (cumulative, non-cumulative, and anti-dilution rights) are also decided in the term sheet.

- Board of Directors: The entry of the venture capitalist makes it somewhat obligatory for the entrepreneurs to define the board of directors usually with one seat appointed to the investor.

- Investor Rights: This section discusses the various rights the investor will be able to exercise in the company. Lawyers intervention is necessary to understand this section.

- Founder Vesting: This section of the VC term sheet is designed in a way to keep the founders engaged with the company for the longest time. A vesting schedule is developed where the founders’ stock becomes subject to vesting based on continued employment and becomes earned usually after four years.

Post Investment Activities

Once the terms are accepted and the deal is finalised, the venture capitalist becomes a part of the company and takes up certain roles and duties. The firm also uses its contacts, partnerships, and experience to help the company grow.

However, most of the VCs don’t take an actual part in the day-to-day working of the company and only intervene when the company deviates from the set goal or at the time of a financial crisis.

That being said, the firm’s representative does become a part of the company’s board of directors.

Exit Plan

VC makes money by exiting the companies with most profits. It becomes a part of the company only to help it grow and increase the value of its shares.

An exit plan is when, how, and to whom the VC will sell its shares to minimize losses and maximise profits. It may exit through an IPO, acquisition by another company, stock buyback, or other ways.

Venture Capital Advantages And Disadvantages

It’s true that investments cannot be denied in most startups. But they have their own costs too, especially in the case of venture capital where millions are on stake.

Advantages of Venture Capital

- Growth Opportunities: The influx of new capital brings many new growth opportunities along and gives the chance to the business to explore new markets and improve the operations.

- Business Expertise: Besides financial backing, VCs also bring in business expertise and a different perspective. They use their experience to provide guidance and consultation and help the company make better decisions and manage effectively.

- Additional Resources: VCs also lend their resources to help their new partners when it comes to critical areas like taxes, finance, personnel matters, etc.

- Connections: VCs that join the company’s board usually have a lot of connections which eventually helps the company in the long run.

Disadvantages of Venture Capital

- Loss of control: With the VC joining as a director of the company, the founders lose a substantial amount of control as they held previously. They now have to consult the person before taking long term decisions.

- Dilution Of Ownership: The ownership stake also reduces as a proportion of the shares are given to the VC in exchange for the investment.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think of our article on venture capital and venture capitalists in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.