A survey done by AIIM has shown that 3 out of every 5 businesses run into legal issues due to poor documentation. This highlights the importance of having well-written and organised business documents.

Business documents are crucial in helping companies optimise their operations, reduce risks and adhere to legal standards. If you don’t have proper documentation, your business could face significant losses that may negatively impact its performance.

So, what types of documents are essential for a company to function efficiently?

In this article, we’ll explain what a business document is and introduce you to the different types of business documents and their purposes.

What Are Business Documents?

A standard business document includes written or printed material describing a company’s operations, activities, or transactions. This can be reports, proposals, contracts, agreements, letters, memos, invoices, receipts, and procedural documents.

It can be anything that comes to mind when related to business.

From the moment your business idea takes form, documentation begins, and this process never really stops as long as the business exists. These documents serve various purposes, including providing evidence of dealings, maintaining operational efficiency, facilitating decision-making, and ensuring compliance with laws and regulations.

Properly maintaining these different types of business documents helps you optimise your processes, reduce risks, and comply with legal standards.

Different Forms of Documents

Various types of business documents are used for different purposes, from facilitating communication to ensuring compliance.

Some of the common forms include policy manuals, which provide a comprehensive overview of company policies and expectations; training materials designed to equip new hires with the necessary skills and knowledge for their roles; and procedural documents, offering step-by-step instructions for specific tasks or operations.

Here are some of the most common types of business documents found in every business:

Documents based on the form

Physical Documents

Physical documents are one of the key types of business documents, encompassing items such as memos, reports, or statements. They are usually written or printed. Physical documents are often used for record-keeping, especially for formal presentations or when a hard copy is required for legal or compliance reasons.

The touchable nature of physical documents often makes them essential for certain legal and formal proceedings where original signatures or official seals are required. Their physicality ensures a level of permanence and security, as they are less susceptible to the kind of data corruption or hacking threats that electronic documents face.

Furthermore, physical documents play a critical role in situations requiring formal presentations or in environments where digital technologies might not be readily available or reliable.

Examples:

- Letters and Contracts: These are often preferred in a printed format for signatures and official endorsements.

- Printed Reports: Essential for meetings where digital devices may not be practical for each participant.

- Legal Documents: Many jurisdictions require certain types of legal documents to be physical copies for them to be considered valid.

Electronic Documents

These documents are in digital format, such as emails, digital reports, spreadsheets, PDFs, and any other electronic document. They can be stored on computers, servers, or cloud-based systems, providing easy access and reducing the need for physical storage space. Thus, they are a more secure and environmentally friendly option.

Examples:

- Emails and Memos: Quick and efficient for everyday communication within and outside the organisation.

- Digital Reports and Spreadsheets: Facilitate real-time data sharing and collaboration among team members.

- PDFs and Electronic Contracts: These allow for secure and immediate distribution, and digital signatures make them as legally binding as their physical counterparts.

Security measures like encryption and password protection enhance their confidentiality, making them a favoured choice for a wide range of business applications.

Additionally, tools that allow you to rearrange PDF pages can help maintain order and ensure the documents are organised in the most logical sequence.

Documents based on the mode of communication:

Internal Documents

Internal documents are a crucial type of business documents, intended for individuals within the company, such as employees. They help keep everyone informed and on the same page.

Think internal memos, which communicate important updates or changes; training manuals, which provide guidelines and instructions for new and existing employees; and company policies, which outline the rules and regulations everyone in the company needs to follow.

These documents ensure that everyone knows what’s going on and how to do their jobs correctly.

Examples:

- Memos and Internal Reports: Serve to efficiently communicate updates, operational results, and directives within the organisation.

- Employee Newsletters: Enhance company culture by sharing news, achievements, and employee spotlights.

- Meeting Minutes: Provide a documented record of discussions and decisions, ensuring transparency and accountability.

External Documents

These go to people outside the company, such as clients, customers, or the general public. They help build relationships and communicate the company’s message to the outside world.

Examples include marketing materials promoting products or services, client proposals outlining potential projects or partnerships, and press releases announcing important news or events.

External documents are important for attracting and retaining clients, as well as maintaining a positive public image.

Documents based on the writing style:

Formal Documents

Formal documents are another essential type of business documents, characterised by their adherence to specific formats. They are usually detailed and carefully drafted because they often have legal or financial implications.

Examples include contracts, financial statements, and legal agreements. These documents ensure that everything is clear and agreed upon, reducing the risk of misunderstandings or disputes.

Informal Documents

These are more casual and often used for everyday communication.

They don’t follow a strict format and are usually quick and to the point, like quick emails, notes, and informal meeting agendas. Informal documents help facilitate quick and efficient communication, making it easier to get things done on a day-to-day basis.

Different Types Of Business Documents

Business creation documents

Certain documents are essential when setting up a new business to establish its legal framework, ensure compliance with regulations, and set the stage for future operations and growth.

Here’s a list of some of these critical documents and their purposes.

Documents of incorporation/organisation (MOA, AOA)

Documents of incorporation or organisation, such as the Memorandum of Association (MOA) and Articles of Association (AOA), are pivotal types of business documents essential for starting a business.

The Memorandum of Association (MOA) and Articles of Association (AOA) are two such preliminary documents that every company must prepare. The MOA and AOA should be filed with the Registrar of Companies (ROC) along with the company incorporation form.

If it’s a corporation, then the Articles of Incorporation (AOA) are filed, which outline your company’s basic purpose and powers; for a limited liability company (LLC), its Articles of Organisation establish its formation and basic structure.

The Memorandum of Association (MOA) and Articles of Association (AOA) outline a company’s work scope, goals, rules, and internal management. These documents are crucial, forming the backbone of the company. Hence, founders must draft them with exceptional clarity and precision.

Memorandum of Association (MOA)

The Memorandum of Association (MOA) is a crucial legal document that defines the company’s constitution and lays down the foundation on which the company operates. It outlines the business’s objectives, scope, and purpose, ensuring stakeholders know what the company is legally allowed to do.

Creating an MOA marks the first step in company registration. During a company’s formation, members must subscribe to the MOA, meaning they endorse it by signing their mark, signifying approval of its contents.

Essential elements of the MOA include:

- Company Name: The official name with which the company will be registered.

- Registered Office Address: The location from which the company will operate.

- Objectives: Primary and ancillary objectives of the company.

- Liability: Information on whether liability for members is limited by shares or by guarantee.

- Capital: The total amount of capital the company will be authorised to use, divided into shares.

This document is publicly available and acts as a charter regulating your company’s external activities.

Articles of Association (AOA):

The Articles of Association (AOA) works in conjunction with the Memorandum of Association, detailing the rules and regulations for the governance and day-to-day operations of the business.

It includes comprehensive guidelines on how decisions must be made within the company.

Every company needs an AOA, as it defines its internal rights, operations, management, and duties. The AOA’s contents must align with the MOA and the Companies Act 2013.

Key components include:

- Directors and Shareholders’ powers and responsibilities.

- Voting rights of stakeholders.

- Dividend distribution policies.

- Meeting guidelines for the board and shareholders.

- Appointment and removal of directors.

The AOA provides a detailed blueprint of internal affairs and management procedures, guiding the leadership to execute their duties effectively and comply with legal requirements.

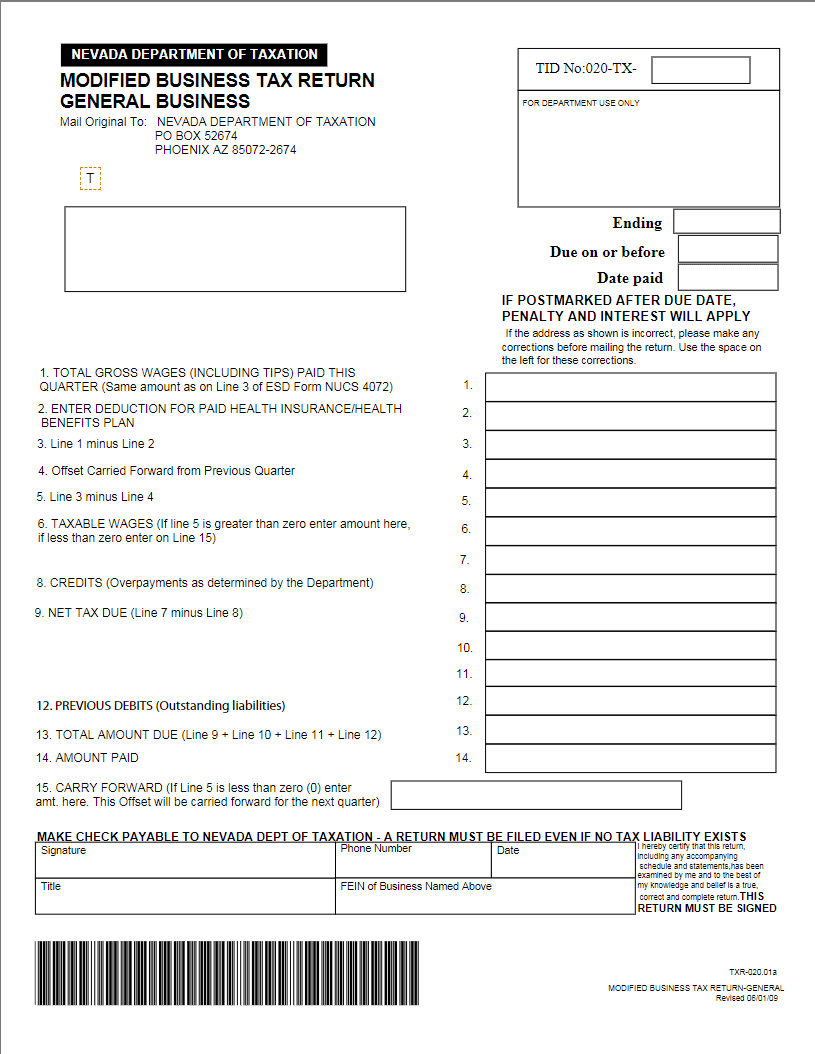

Tax Identification Number (TIN)

A Tax Identification Number (TIN) is an essential type of business document for any company concerning tax administration. Issued by local tax authorities, this unique identifier tracks the company’s transactions and ensures compliance with the respective country’s tax obligations.

It is issued either by the Social Security Administration (SSA) or by the IRS. The SSA issues a Social Security number (SSN), whereas the IRS issues all other TINs.

It’s like a fingerprint for the business in the world of taxes and finance. Different countries may have their own versions of TINs with varying formats and requirements. In some places, they might be called Business Number, Company Registration Number, or something similar.

Types of TINs Used by Businesses

- Employer Identification Number (EIN): Issued by the IRS to corporations, trusts, estates, partnerships and other entities for tax filing and reporting purposes.

- Individual Taxpayer Identification Number (ITIN): Issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but who do not have and are not eligible for a Social Security Number (SSN)

Having a TIN is crucial for maintaining compliance with tax laws. It allows tax authorities to track a business’s tax obligations and payments accurately.

Other businesses or financial institutions often require TINs when entering into certain transactions or partnerships. TINs are also used in a variety of contexts beyond just tax filing.

For example, they’re often required on information returns for reporting things like interest paid, dividends distributed, or payments made to independent contractors.

The TIN itself is a unique number assigned to the business. The application process for obtaining a TIN collects various pieces of information about the business, including:

- Legal name of the business

- Business structure (e.g., sole proprietorship, partnership, corporation)

- Physical and mailing address of the business

- Nature of the business and its principal activities

- Owner’s or responsible party’s personal information, including their name and SSN or Individual Taxpayer Identification Number (ITIN)

- Date the business was started or acquired.

Permits and Licences

Certain permits and licenses are essential types of business documents required to operate legally, depending on the nature and location of the business. These documents can range from general business licenses to specific permits related to environmental regulations, health and safety, and industry-specific requirements.

They include general business licenses, professional licenses, zoning permits, and health permits. The type of permits needed can vary widely depending on the nature of the business.

For example, a restaurant might need a food service license, while a construction company might require contractor permits.

Permits serve several purposes. They ensure that businesses meet certain standards and regulations, which helps protect consumers and the public. They also allow local governments to keep track of business activities in their area.

For some businesses, having the proper permits is a legal operation requirement.

Depending on the permit, some of the basic information it contains are:

- The business name and address

- Owner or responsible party’s information

- Type of business and description of activities

- Specific conditions or requirements that must be met (e.g., health and safety standards)

- Validity period and renewal information

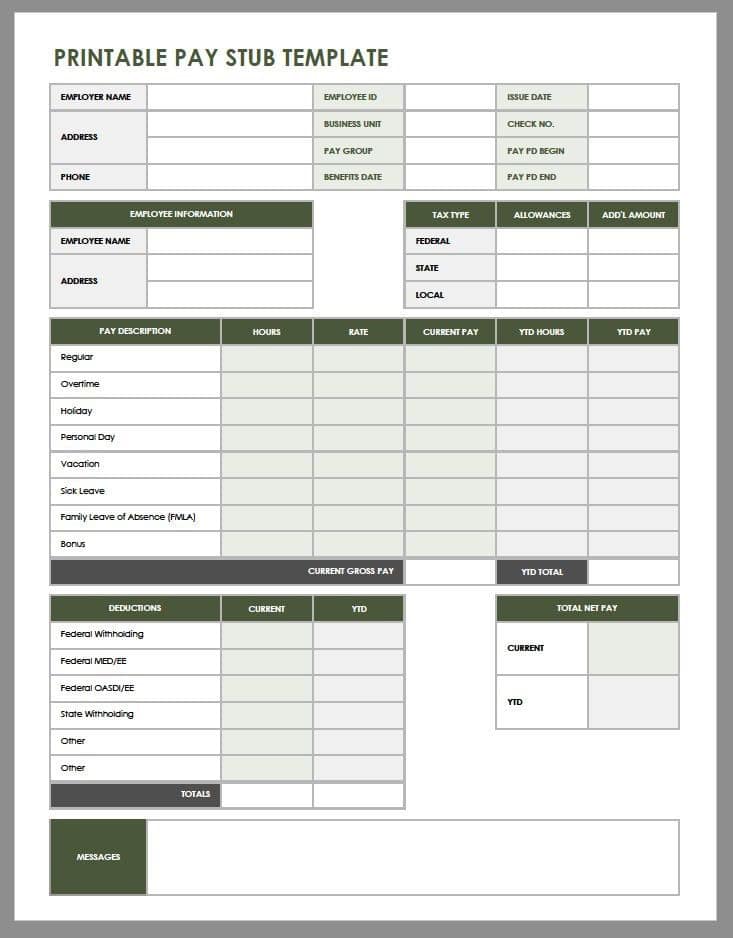

Payroll Records and Tax Forms for Employees

Payroll records and tax forms for employees are crucial types of business documents for managing payroll effectively and adhering to tax regulations. These documents include detailed records of employees’ salaries, bonuses, deductions, and taxes.

Additionally, employers must complete certain tax forms for their employees to comply with tax withholding and reporting requirements.

Payroll records typically include detailed information about each pay period. They track an employee’s hours worked, wage rate, gross pay, deductions, and net pay.

These records might also include information about overtime, bonuses, commissions, and other compensation forms. Payroll records document that employees are being paid properly and following labor laws and regulations.

They provide proof of hours worked, wages paid, taxes withheld, and other payroll information required by government agencies. Tax forms like W-2, 1099, and W-4 ensure employers withhold the correct amount of taxes from employee paychecks.

Additionally, maintaining detailed payroll records helps protect the business in case of disputes with employees or audits by tax agencies.

Some of the key information that a Payroll Record contains are:

- Employee’s full name, address, and Social Security Number (SSN)

- Dates of employment and pay periods

- Hours worked, including regular and overtime hours

- Gross wages earned

- Deductions for federal, state, and local taxes

- Deductions for benefits (e.g., health insurance, retirement plans)

- Net pay (take-home pay)

- Any other withholdings or garnishments

Compliance and Regulatory Documents

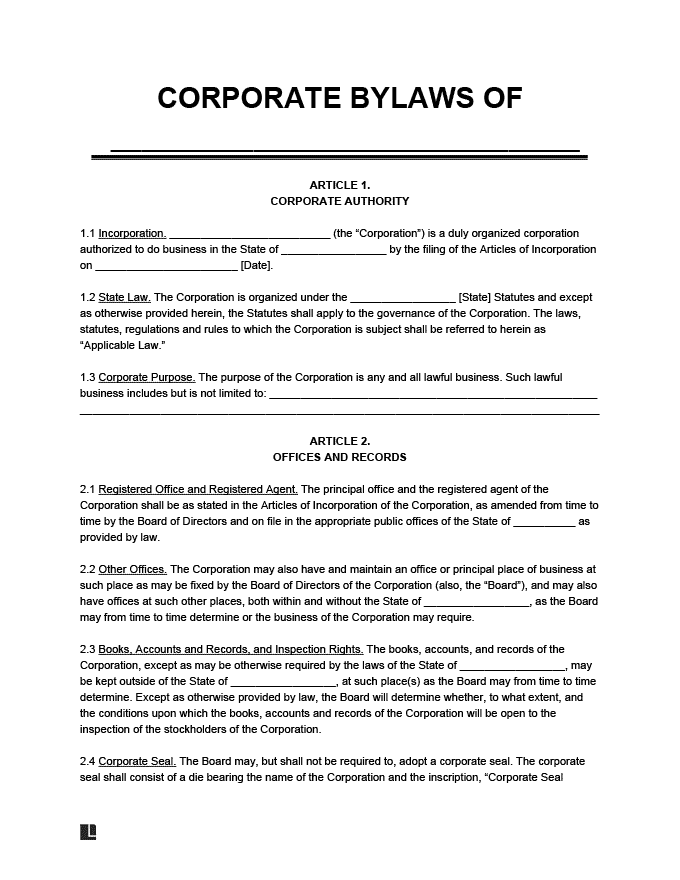

Bylaws

Corporate Bylaws can be likened to a constitution for your business entity, setting forth the internal rules and structures. They outline the operational framework of a corporation, including the governance of its board of directors, the issuance of stock, and the organisation of corporate meetings.

By defining roles, duties, and procedures, bylaws ensure that the company operates like a well-oiled machine, adhering to both legal requirements and internal standards of conduct.

Bylaws are an indispensable reference for conflict resolution and decision-making, providing a set of established rules to follow when ambiguous situations arise.

They also ensure compliance with state and federal regulations, protecting the corporation from legal issues.

Typical components of corporate bylaws include:

- Business Name

- Address

- Status (Public or Private)

- Operational Framework

- Management Guidelines

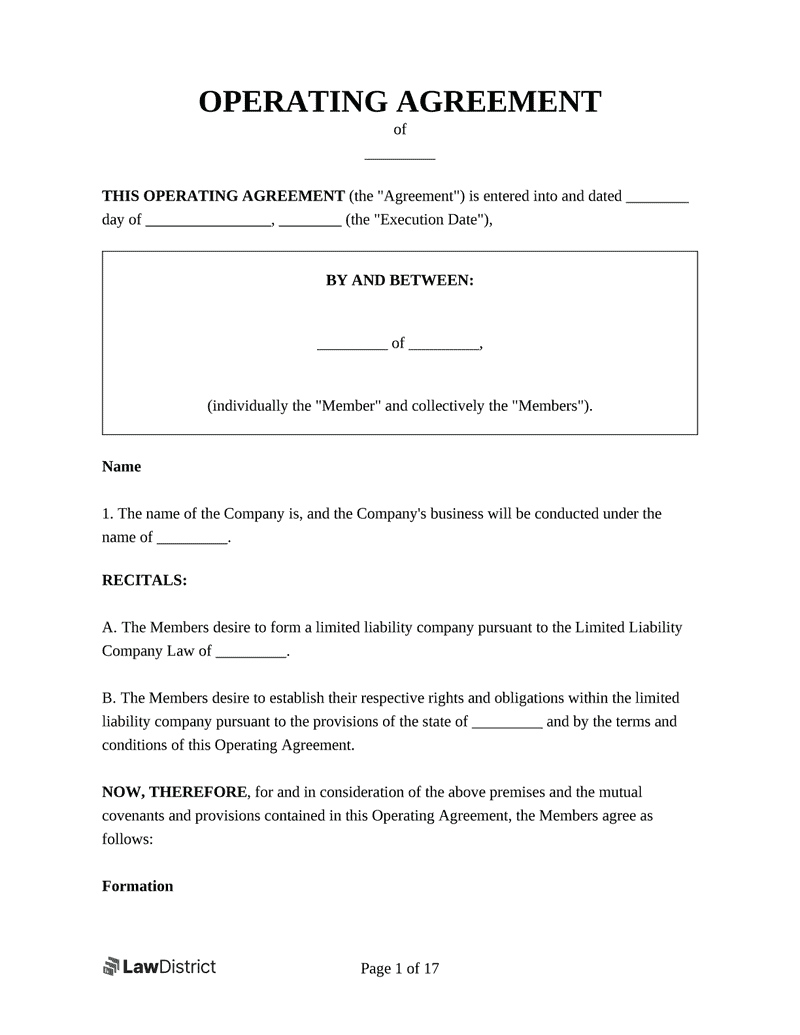

Operating Agreements (for LLCs)

Operating Agreements are essential types of business documents for any Limited Liability Company (LLC). It describes the business’s financial and functional decisions, including rules, regulations, and provisions.

This document governs the business’s internal operations in a way that suits the specific needs of the business owners.

The LLC members draft it and does not typically need to be filed with the state.

However, an Operating Agreement is critical as it provides structure and legal documentation of the business’s policies, ensuring the LLC is treated as a separate business entity.

Operating Agreements vary significantly from one LLC to another, primarily because they are tailored to the business’s unique structure and requirements. They can detail everything from the allocation of profits and losses to member responsibilities, dispute resolution procedures, and adding or removing members.

Elements Included in Operating Agreements:

- Ownership Details: Specifies the percentage ownership each member has in the business, usually determined by the initial investment amount.

- Management Structure: Describes whether the LLC will be member-managed or manager-managed, including the members’ or managers’ roles and powers.

- Capital Contributions: Outlines the initial contributions of each member to the business and how additional contributions will be handled.

- Distribution of Profits and Losses: Details how the LLC’s profits and losses will be divided among the members.

- Membership Changes: Processes for adding new members, transferring membership interests, and protocols for when a member leaves the LLC.

- Dissolution Procedures: Guidelines for winding up and dissolving the business, detailing how the assets will be distributed.

Even though Operating Agreements are not mandatory in some states, they are highly recommended.

LLCs are subject to the state’s default rules without an Operating Agreement. An Operating Agreement supersedes state guidelines, offering businesses flexibility and control over their operations, structure, and governance.

Minutes of shareholder and board meetings are official records that document the discussions and decisions made during formal gatherings of a corporation’s shareholders and its board of directors.

Taking and approving minutes typically falls to a designated individual, often the corporation’s secretary or another appointed officer. After the meeting, the drafted minutes are usually circulated among the participants for review and then formally approved at the beginning of the next meeting.

Importance of Meeting Minutes:

- Legal Protection: Minutes can serve as a legal document in the event of lawsuits or audits, showing that the corporation has been operating following laws and regulations.

- Record Keeping: They offer a written record of the company’s operational and strategic decisions, helping track progress over time.

- Accountability: Minutes hold the board and shareholders accountable for their decisions and actions, ensuring that commitments made during the meetings are fulfilled.

- Communication: They facilitate communication with not present stakeholders during the meetings, keeping everyone informed of the company’s direction and policy changes.

Elements Included in Meeting Minutes are:

- The meeting’s date, time, and location to establish when and where it was held.

- Names of participants, including directors, shareholders, and executives in attendance, as well as any absentees.

- Agenda items discussed during the meeting, providing a general overview of the topics covered.

- Decisions made and actions taken including any resolutions passed, elections of officers or directors, and approvals of contracts or agreements.

- Voting outcomes for each decision, often detailing how each member voted.

- Future plans and tasks, including assignments of responsibilities and deadlines for upcoming projects or decisions.

Organisation & Operations

Developing business documents for your organisation’s processes and operations establishes a systematic framework. This approach enhances efficiency by clearly outlining and organising all necessary information.

Here are five essential documents for achieving this:

Business Plan

The Business Plan is often considered the DNA of your business, containing the genetic instructions of your company’s birth, growth, and evolution. It serves as a comprehensive blueprint, guiding your venture from an abstract idea to a thriving enterprise.

Creating a business plan involves extensive market research and analysis, which clarifies the steps your business needs to take to achieve its goals.

For instance, companies like Apple, Microsoft, and Salesforce all began with a solid business plan.

While not a legal document, a business plan is crucial for generating confidence in potential investors and demonstrating your ability to generate a return on their investment.

Think of it as an architectural plan for a building—it is not merely a suggestion but a well-reasoned, detailed strategy that breathes life into your business vision.

It usually follows this template:

- Executive Summary

- Company Description

- Market Analysis

- Product/Service Analysis

- SWOT Analysis

- Marketing Plan

- Financial Plan

- Budget

- Logistics and Operations Plan

These types of business documents are essential for outlining a clear path to success and attracting the necessary support from investors and stakeholders.

Business Reports

Business reports provide information and insight into an organisation’s internal operations.

They provide real-time insights into various company functions, including sales, finance, human resources, and inventory. Regular reports—quarterly and annual—are diagnostics that enable you to make informed, strategic decisions, ensuring that your company effectively achieves its goals.

At the end of the year, a separate annual report is filed, accompanied by a letter from the CEO that provides a comprehensive summary of the year’s performance and outlines strategies and goals for the upcoming year.

These documents detail performance metrics, analyse trends and challenges, and communicate the company’s status to stakeholders. A strong reporting system builds transparency and accountability, which are crucial for gaining investor trust and guiding your business towards continuous improvement.

A business report usually follows this flow:

- Executive Summary

- Introduction to Issues

- Analysis of Issues

- Conclusion and Potential Solutions

- Data References

- Appendix

Partnership Agreement

A Partnership Agreement lays down the interpersonal blueprint of your business relationships. It’s a critically binding document that explicates the division of labour, profits, losses, and responsibilities among the partners.

Partnerships can be intricate, often leading to potential conflicts. Partnership agreements help address these challenges by establishing clear guidelines for business operations.

Such an agreement encompasses ownership percentages, management roles, decision-making powers, and dispute resolution and termination procedures.

It’s the rulebook for the partnership game, outlining how to play fair, share rewards, and settle scores while also contemplating scenarios like a partner’s departure or the sale of ownership rights.

This also reassures the parties that they have legal and liability protection against each other.

They usually include:

- Percentage of Ownership

- Division of Profits/Losses

- Duration of Partnership

- Management Power/Role

- Decision-Making Power/Role

- Dispute Resolution

- Termination Options

- Buyout Options

Corporate Bylaws

Corporate Bylaws can be likened to a constitution for your business entity, setting forth the internal rules and structures. These types of business documents outline the operational framework of a corporation, including the governance of its board of directors, the issuance of stock, and the organisation of corporate meetings.

By defining roles, duties, and procedures, bylaws ensure that the company operates like a well-oiled machine, adhering to both legal requirements and internal standards of conduct.

Bylaws are an indispensable reference for conflict resolution and decision-making, providing a set of established rules to follow when ambiguous situations arise.

They also ensure compliance with state and federal regulations, protecting the corporation from legal issues.

Typical components of corporate bylaws include:

- Business Name

- Address

- Status (Public or Private)

- Operational Framework

- Management Guidelines

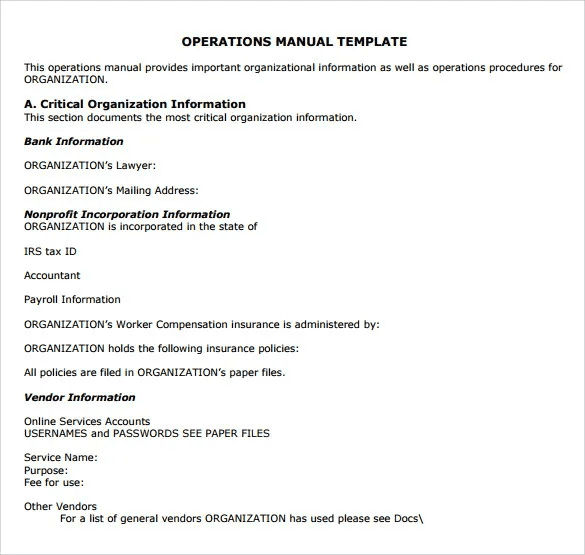

Operations Manual

The Operations manual is a comprehensive playbook detailing the day-to-day activities necessary for your business to function smoothly. It serves as a reference guide for employees and ensures consistency in task execution.

Much like a meticulous recipe book for a chef, an Operations Manual provides the precise ingredients and steps your employees need to achieve consistency, quality, and efficiency in their tasks.

By standardising processes and providing a quick reference for operational questions, it empowers your team to perform their roles with confidence and competence. It also minimises errors and ensures that everyone follows the same protocols.

A usual operations manual includes:

- Company Introduction

- Vision and Values

- Administration Manual

- Finance Manual

- Human Resources Manual

- Marketing Manual

Finance

Another area where business documents are integral is on the financial side. They fulfil various functions, such as recording transactions, ensuring accurate bookkeeping, providing a clear audit trail for regulatory authorities, and maintaining full transparency.

Here are six essential financial documents every business should have:

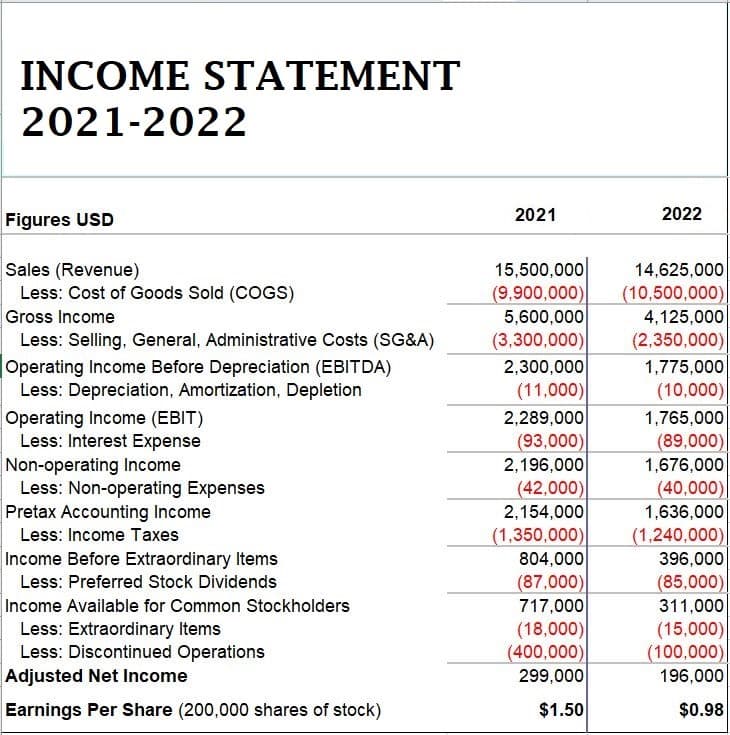

Income Statement

The Income Statement, also known as the Profit and Loss Statement, is a crucial type of business document that narrates the story of your company’s economic activities over a specific period.

This document is the fiscal mirror reflecting revenues earned and expenses incurred, ultimately revealing the net profit or loss.

It allows businesses to track their financial success, identify trends, and measure efficiency.

An income statement reveals an organisation’s profitability and is crucial for assessing its financial health. It offers business owners insights into cost-cutting opportunities and strategies for boosting revenue to enhance profits.

Maintaining income statements and diligently tracking finances are essential for understanding the flow of money within the business.

An income statement usually follows this format:

- Sales

- Gross margin

- Operating expenses

- Operating income

- Other income and expenses

- Income before tax

- Net income

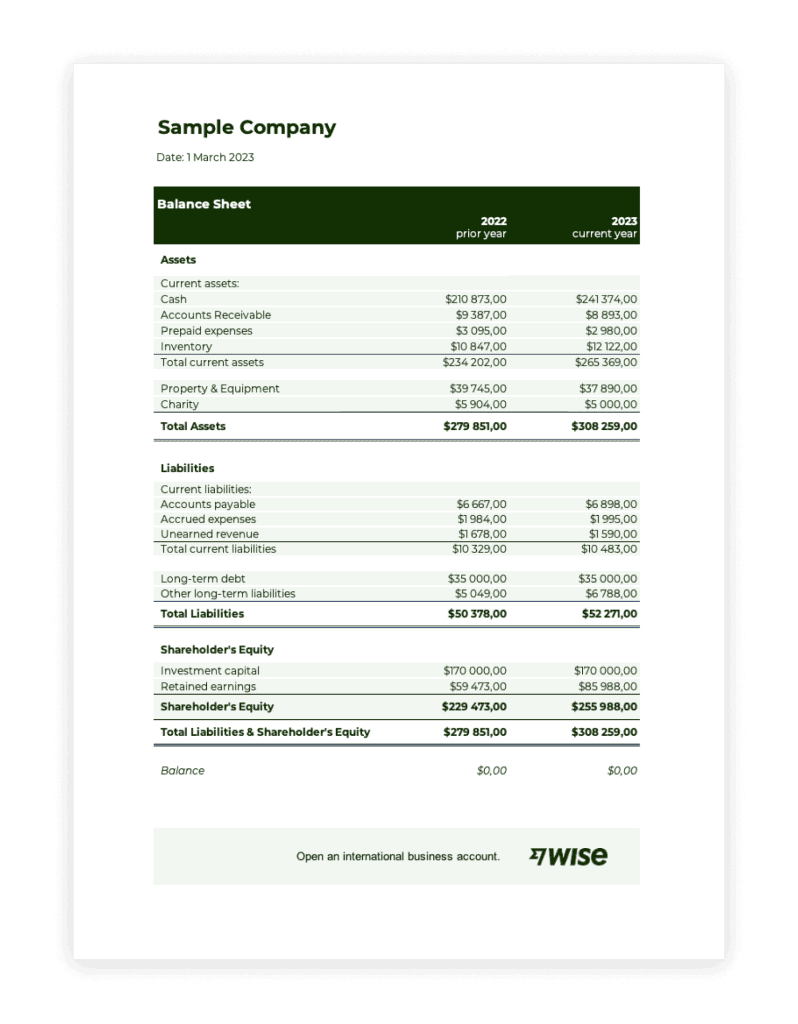

Balance sheets

A balance sheet is a fundamental document that presents a company’s financial position at a specific point in time. It is a cornerstone of financial reporting, providing a comprehensive overview of a company’s assets, liabilities, and shareholders’ equity.

The balance sheet is essential for stakeholders to evaluate the company’s net worth and financial health.

Key Components of Balance Sheets:

- Assets: Classified into current (cash or other assets that are expected to be converted into cash within a year) and non-current assets.

- Liabilities: Similarly, categorised into current (due within a year) and long-term liabilities.

- Shareholders’ Equity: Represents the owners’ claim after debts have been settled, essentially the company’s net assets.

A balance sheet shows a company’s assets, liabilities, and shareholders’ equity. Along with other key financial statements, balance sheets are essential for fundamental analysis and calculating financial ratios.

Accounts receivable/payable

Accounts Receivable (AR):

This financial document represents the money owed to the company by its customers for goods or services delivered but not yet paid for. AR is a critical asset that affects the cash flow and is a key indicator of the company’s revenue and short-term financial health.

- Importance of AR: Efficient accounts receivable management is essential in ensuring that the company has enough working capital and maintains a steady cash flow.

- Accounts Receivable Turnover Ratio: An important metric that measures how effectively a company manages its AR and collects customer debt.

Accounts Payable (AP):

Conversely, accounts payable encompasses the money a company owes to its suppliers or creditors for products or services received. AP represents a liability on the balance sheet and requires careful management to avoid liquidity issues or damaging valuable supplier relationships.

- AP Management: Ensuring timely payments is crucial for maintaining good supplier relationships and can also offer opportunities for discounts and better terms.

- Cash Flow Implications: Proper management of accounts payable helps optimise the company’s cash flow, ensuring sufficient funds are available for day-to-day operations and investment opportunities.

Payment Agreement

A Payment Agreement is a crucial type of business document, functioning as a legally binding contract that outlines the payment terms between a payee and a payor. This can include any individual or entity, such as a business or a bank.

This document is the spine of trust between parties in a transaction, delineating due dates, instalment schedules, interest rates, and penalties for late payments. It is a prophylactic measure against misunderstandings and financial disputes, providing all parties with clear, binding terms for monetary exchange.

Payment Agreements are versatile, serving various scenarios from lending terms for a financial institution to arranging payment plans with customers. You’ll also need them when you invest in another business or individual as a part of your operation.

Typical Components of a Payment Agreement:

- Names of Parties Involved

- Amount of Money Owed

- Payment Plan Details

- Payment Method

- Payment Schedule

- Termination Clauses

Tax Documents

Tax Documents are the business world’s navigational charts, ensuring your company’s course remains aligned with governmental tax regulations and requirements.

These range from filings like income tax returns to specific forms for payroll, sales taxes, and deductions.

Maintaining detailed records and accurate tax documentation is vital. Like a lighthouse guiding ships, these practices help businesses navigate legal scrutiny and audits. Paying close attention to these documents protects companies from penalties and strengthens their financial reputation.

Typical Components of Tax Documents:

- Tax Returns (Federal, State, Local)

- Tax Filings and Payments

- Tax Planning Strategies

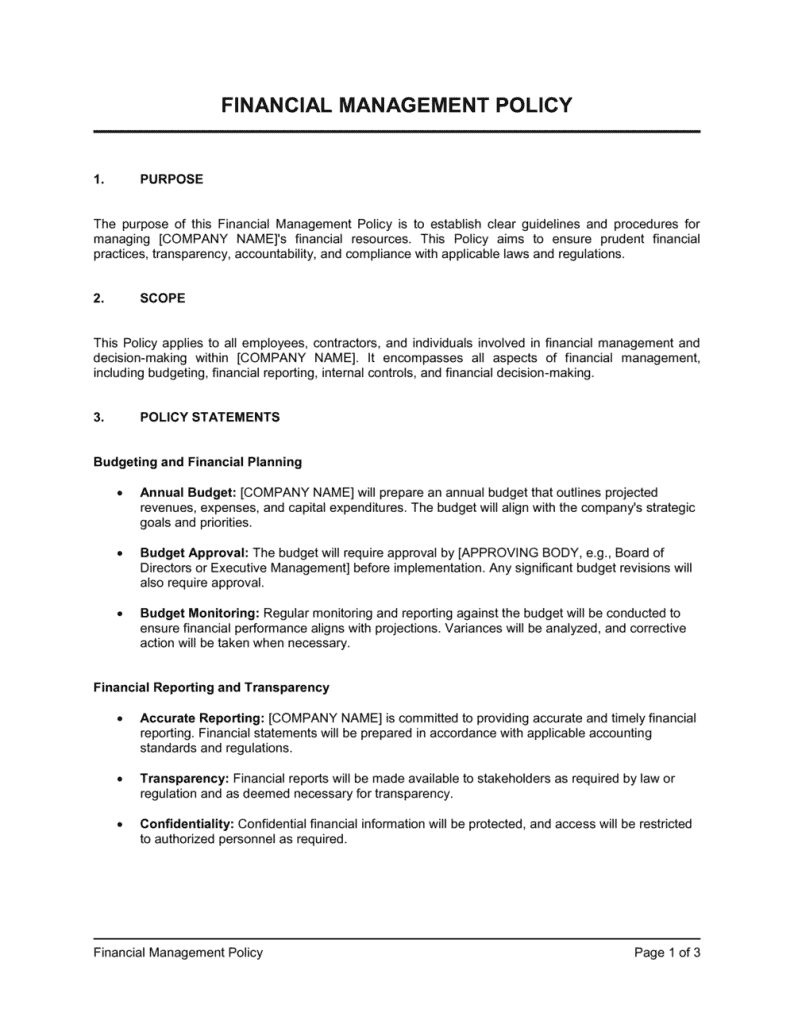

Financial Policies and Procedures

Financial Policies and Procedures manuals are critical types of business documents, serving as the architectural blueprints for building a strong, resilient financial framework within an organisation. These documents outline the codified standards and protocols for financial management, covering aspects such as budgeting, accounting, cash management, and internal controls.

Acting as the rulebook for financial conduct, these policies and procedures help to prevent errors, fraud, and inefficiencies, ensuring that every financial transaction complies with established best practices and ethical guidelines. They promote fiscal discipline and accountability, enabling employees to navigate the complexities of financial operations with clarity and precision.

Typical Components of Financial Policies and Procedures:

- Accounting Policies

- Treasury Management Policies

- Credit and Collections Policies

Business reports

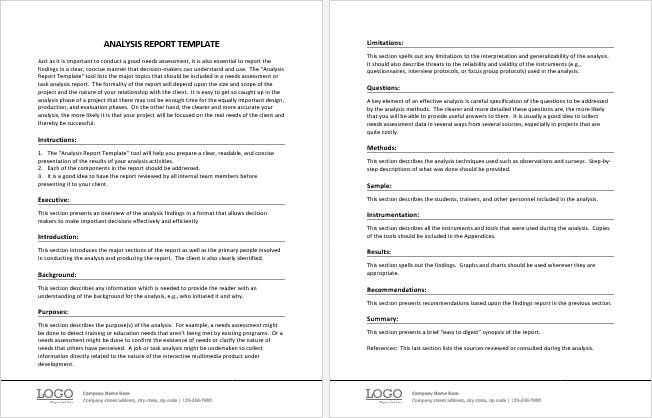

Analytical reports

An analytical report is a detailed and systematic document that thoroughly breaks down a specific issue, situation, or problem. It achieves three main goals: assessing possible opportunities, identifying solutions to problems, and supporting decision-making.

This complex type of report is instrumental because it goes beyond presenting facts—it offers an in-depth analysis backed by data, and it typically offers conclusions and recommendations based on that analysis.

For example, a Chief Marketing Officer (CMO) might consult a business executive’s analytical report to pinpoint pandemic-related challenges before adjusting their marketing strategy.

The writing style and insights that analytics reports generate depend on the industry.

Key Features of Analytical Reports:

- Problem Exploration: Identifies and examines a particular business dilemma or opportunity.

- Data Analysis: Incorporates quantitative and qualitative data to support its exploration.

- Recommendations: Provides actionable suggestions based on the documented analysis.

- Structured Format: Usually follows a logical progression, beginning with an introduction, followed by methodology, analysis, conclusions, and recommendations.

Analytical reports are invaluable when organisations face significant decisions, such as entering new markets, adjusting strategies, or when trying to understand the underlying causes of workplace issues.

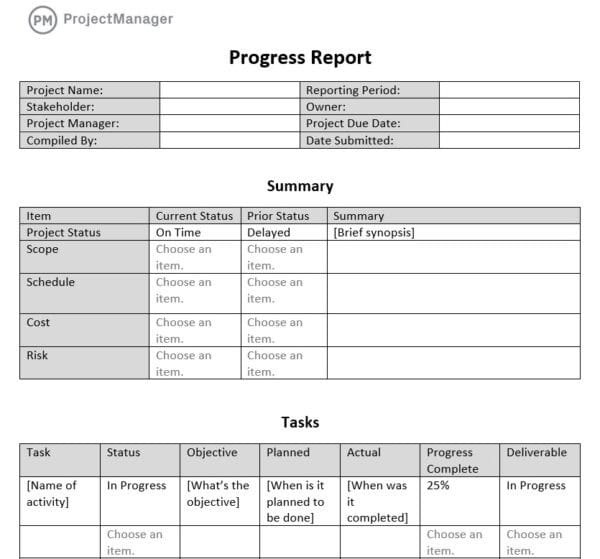

Progress reports

As businesses undertake projects or continue their operations, keeping track of development and growth is of utmost import. This is where progress reports come in. These documents update the ongoing activities or the status of a particular project within the organisation.

Clients need to stay updated on a project to modify assignments, schedules, and budgets as needed. These reports, which cover projects from start to finish, are issued regularly. For internal progress reports, use a memo; for external ones, send a letter.

Characteristics of Progress Reports:

- Time-bound Updates: Regularly track and communicate the advancement of projects or initiatives over time.

- Status Overview: Give a snapshot of where things stand, potentially comparing progress to planned benchmarks.

- Problem Identification: Alert managers to any delays, issues, or deviations from the planned course of action.

- Future Forecast: Offer a preview of the next steps and any adjustments needed for project completion.

Progress reports are essential for maintaining transparency, ensuring parties involved are aware of any successes or challenges, and enabling a proactive approach to project management.

Explanatory reports

When complex situations, processes, or sets of results require clarification, explanatory reports are the go-to documents. For instance, it could be the research you’ve conducted or a project you’ve completed.

In this report, you should outline your goals, methodology, findings, and recommendations for future actions.

This type of report can take various forms, such as instructional manuals, user guides, or informational brochures.

Essentials of Explanatory Reports:

- Simplified Explanations: Translate technical jargon or complex situations into comprehensible terms.

- Contextualisation: Connect data or events to a larger framework to illustrate their significance.

- Guides and How-tos: Often used to describe procedures or instructions for tasks and operations.

- Facilitate Understanding: Help stakeholders grasp the nuances of specific business activities or findings.

Explanatory reports are particularly useful in training scenarios, when introducing new technology or processes, or when presenting research findings that require elucidation.

Informational reports

The primary objective of informational reports is to provide data or factual information without analysis or recommendations. This kind of report informs decision-making by presenting facts in a neutral, objective manner.

These reports are typically read by those making intricate business decisions, such as a company’s board of directors or major stockholders. The primary goal of an informational report is to equip these key individuals with sufficient data to draw meaningful conclusions on a specific topic.

Attributes of Informational Reports:

- Data Compilation: Assemble relevant facts and figures for review.

- No Analysis: Present information without personal bias or interpretation.

- Clear and Concise: Written in an easily digestible format highlighting essential data.

- Wide-ranging Use: These can be financial reports, such as quarterly sales figures, or operational, like summaries of monthly website traffic.

Informational reports are a staple in organisations that require regular dissemination of facts without the need for interpretation, such as in routine reporting to higher management or when sharing information between departments.

Contracts and Agreements

Confidentiality Agreements

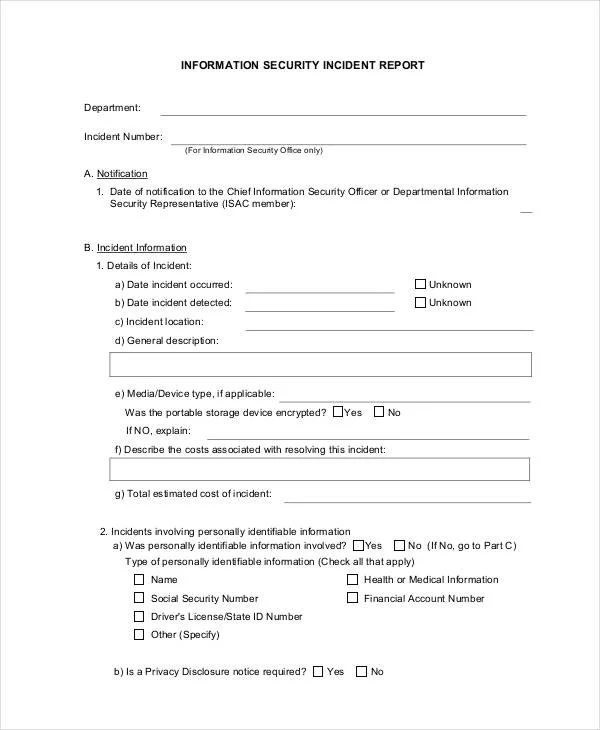

Confidentiality Agreements, often known as Non-Disclosure Agreements (NDAs), are vital types of business documents for safeguarding sensitive information. By signing this agreement, parties agree not to disclose information outlined as confidential.

These agreements are established between an organisation and various parties involved in its operations, such as employees, business partners, contractors, and freelancers. They legally compel the signatory to uphold confidentiality, with breaches potentially resulting in severe consequences.

The importance of this document cannot be overstated, especially in industries dealing with proprietary information or client data.

A confidentiality agreement usually includes:

- Parties Definition: Clearly identifies who is involved and bound by the agreement.

- Confidential Information: Includes a detailed definition of all the information considered confidential.

- Obligation Period: Specifies how long the confidentiality measures must be in place.

- Consequences of Breach: Details the legal actions that will be enforced should any party fail to keep the information secure.

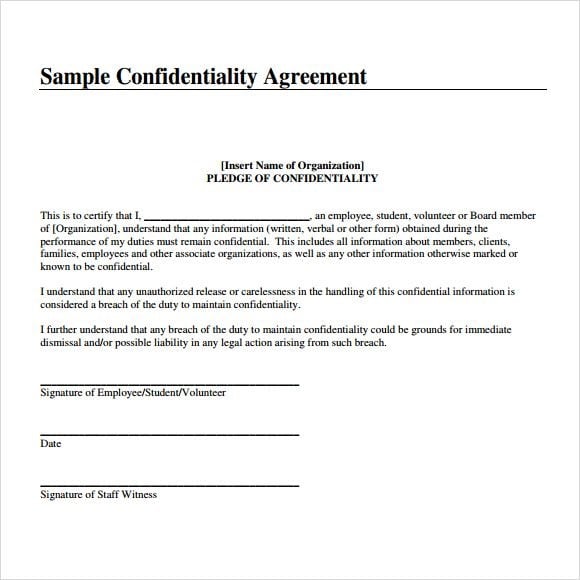

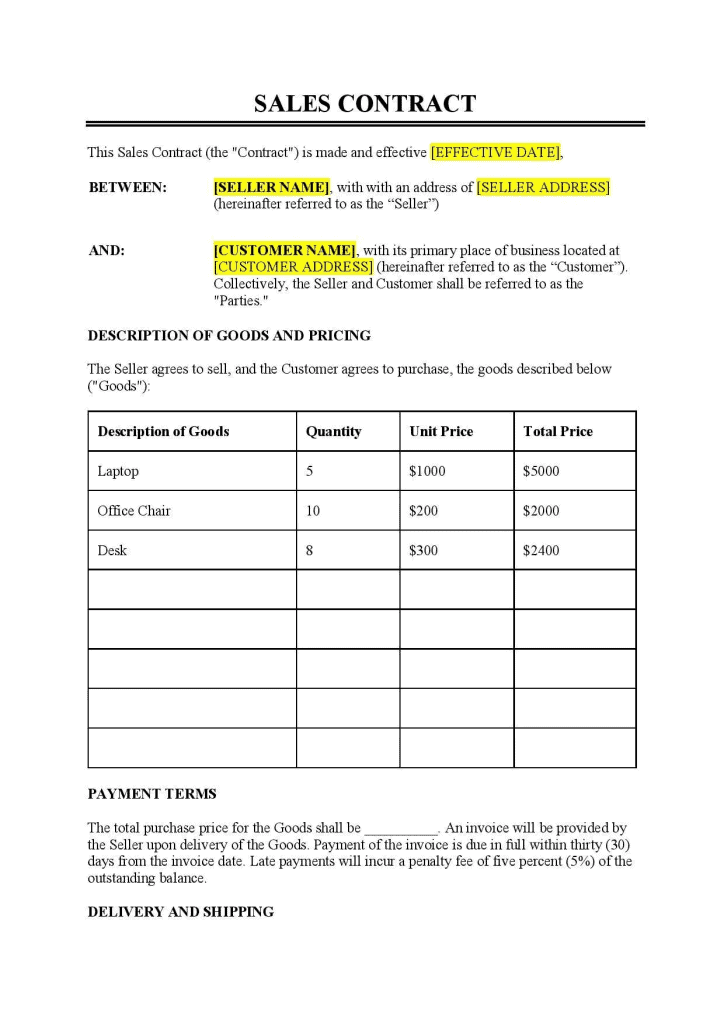

Sales contracts with clients, vendors, affiliates

Sales contracts are a critical type of business document that outline the terms and conditions of a transaction between a seller and a buyer. They are important for establishing clear expectations and protecting the interests of the businesses involved, whether it be with clients, vendors, or affiliates.

Relevance of Sales Contracts:

- Clarity of Terms: Specifies the price, quantity, delivery dates, payment terms, and quality requirements, reducing the potential for misunderstandings or disputes.

- Risk Mitigation: Offers legal recourse if any of the parties involved do not meet the terms of the contract.

- Strategic Relationships: Helps solidify relationships by setting forth a clear and equitable framework for cooperation.

Here are some common sales contracts and their significance:

Client Sales Contracts

Client sales contracts are formal agreements between a business and its customers detailing the products or services to be provided, payment terms, delivery schedules, and other critical specifics.

These contracts safeguard the business by clearly outlining expectations and responsibilities. They help prevent disputes and ensure customers receive what they were promised.

Key Elements: The product/service description, pricing, payment terms, delivery/installation, warranties, termination clauses, and more.

Vendor Contracts

Vendor contracts are agreements between a business and its suppliers, specifying the terms of the business relationship.

These contracts help maintain a reliable supply chain, secure favourable pricing, and enforce quality control. They also limit liability if the vendor fails to meet performance standards.

Key Elements: Scope of work, pricing, delivery schedules, quality standards, termination rights, confidentiality clauses, etc.

Affiliate Contracts

Affiliate contracts are agreements between a business and its affiliate marketing partners, outlining the commission structure, promotional guidelines, and other terms of the partnership.

These contracts protect the business’s brand and intellectual property while motivating affiliates to generate sales and leads.

Key Elements: Commission rates, tracking methods, brand usage guidelines, termination clauses, exclusivity terms, etc.

Leases

Leases are agreements in which one party, the lessor, grants another party, the lessee, the right to use an asset for a predetermined period in exchange for payment. This can apply to real estate, equipment, vehicles, and other tangible assets.

Leases enable you to access and utilise assets without needing significant upfront capital for outright purchase.

Importance of Leases:

- Fixed Terms: These terms stipulate the rent, deposit, duration, maintenance obligations, and renewal options, providing stability for both the lessor and lessee.

- Legal Protection: Defines conditions under which the lease can be terminated, safeguarding the interests of both parties.

- Operational Flexibility: Enables businesses to utilise assets without the hefty initial investment, allowing for better cash flow management and operational agility.

Businesses usually encounter two main types of leases:

Operating Leases

An operating lease is a rental agreement where the lessor retains ownership of the asset, and the lessee pays to use it for a specified period.

Some key features:

- The lessee does not gain ownership of the asset.

- The lease term is generally shorter than the asset’s useful life.

- The lessor handles maintenance and repairs.

- Lease payments are recorded as operating expenses.

Examples: Leasing office space, equipment, vehicles, or other assets essential for business operations.

Finance Leases (Capital Leases)

A finance lease is a lease arrangement that transfers most of the risks and rewards of ownership to the lessee.

Some important features:

- The lessee acquires most of the economic benefits of asset ownership.

- The lease term covers a significant portion of the asset’s useful life.

- The lessee is responsible for maintenance and repairs.

- Lease payments are treated as financing transactions.

Examples: Leasing specialised equipment, machinery, or real estate critical to the business’s core operations.

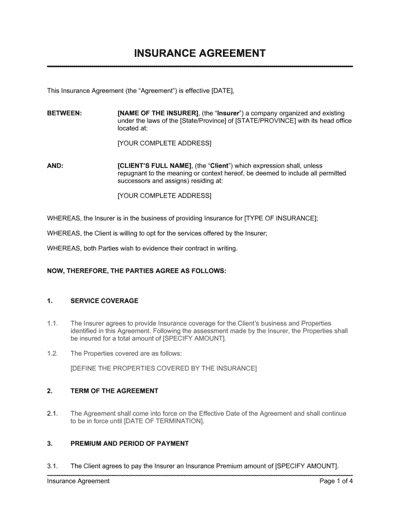

Insurance policies

In a world of uncertainty, insurance policies are essentially financial instruments that transfer the risk of loss from an individual or business to an insurance company. They outline the contractual agreement between an insured party (the business) and an insurance provider.

They provide a safety net against unforeseen events with significant financial implications.

Some key functions of Insurance Policies:

- Risk Management: Mitigate potential financial losses due to accidents, theft, natural disasters, or other liabilities.

- Regulatory Compliance: Many types of insurance, such as workers’ compensation and professional liability insurance, are required by law for certain types of businesses.

- Business Continuity: Ensures that a business can recover and continue operations after an unexpected loss.

Some examples of insurance policies are: property insurance policies, liability insurance policies, and cyber liability policies.

Licensing and intellectual property agreements

Innovation and creativity are the lifeblood of many enterprises, necessitating licensing and intellectual property agreements. These contracts protect and manage the rights associated with creative works and inventions.

Much like a protective shield, they ensure that the creations of your mind—ranging from inventions and literary works to symbols and designs—are duly recognised and compensated.

Issuance of these agreements usually involves two primary entities: the licensor, who owns the intellectual property, and the licensee, who is granted permission to use the IP under specified conditions.

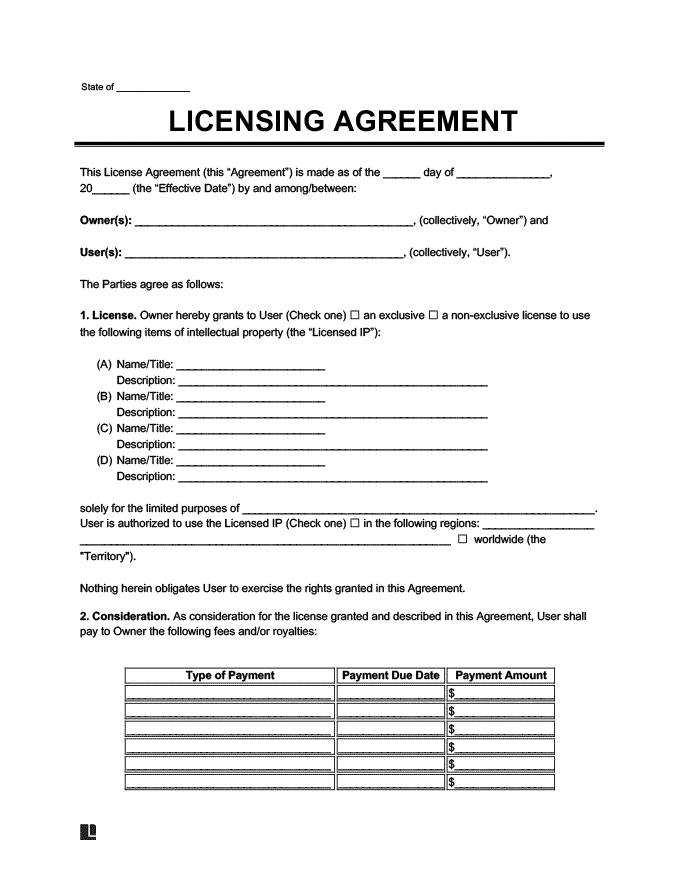

Licensing Agreements

Licensing agreements permit one party (the licensee) to use another party’s (the licensor) intellectual property in exchange for royalties.

Key Elements: Scope of use, geographical restrictions, exclusivity, royalty rates, term length, quality control provisions, and termination clauses.

These agreements allow businesses to monetise their intellectual property without requiring significant capital investment, generate passive income, and protect the licensor’s rights.

Examples: Software licensing, trademark licensing, patent licensing, and copyright licensing agreements.

IP Assignment Agreements

IP assignment agreements transfer intellectual property ownership from one party (the assignor) to another (the assignee).

Key Elements: Identification of the specific IP being transferred, warranties, limitations on use, and compensation.

These agreements enable businesses to acquire valuable intellectual property rights, enhance their competitive position, generate revenue, or prevent others from using the IP.

Examples: Transferring patent, trademark, or copyright ownership from an inventor or creator to a business entity.

Managing teams and employees becomes increasingly important as your business expands.

HR documents are essential for tracking employee information, maintaining records, and assessing performance.

Here are the most commonly found HR documents:

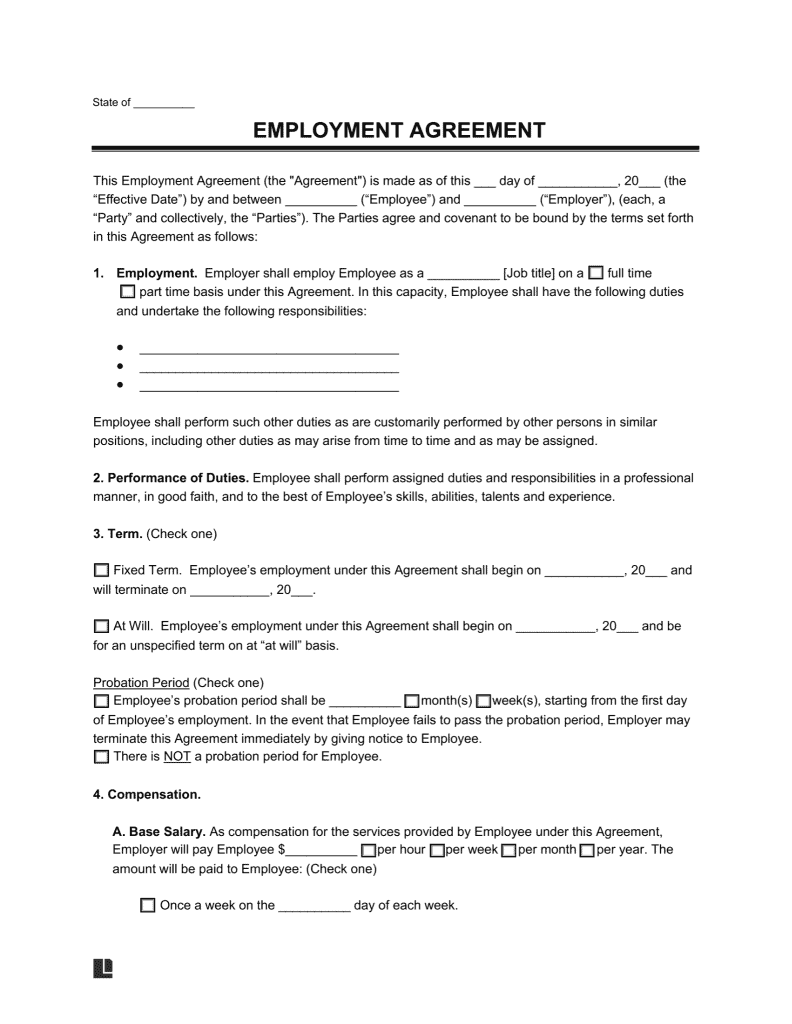

Employment Contract Agreement

An Employment Contract Agreement is fundamental to establishing the framework of the employment relationship. This document outlines the rights, responsibilities, and obligations of both the employer and the employee.

The document includes details such as the terms and conditions of employment, deliverables, work hours, pay rates, and benefits. As a business, hiring people necessitates having employment contract agreements. Without these legally binding contracts, both parties could face risks.

An employment contract agreement offers protection to both parties. It safeguards employers from employees not fulfilling their duties and ensures employees receive their pay and are not exploited.

An employee contract agreement follows this format:

- Role Description: Clearly outlines the job duties and responsibilities.

- Compensation and Benefits: Details salary, bonus potentials, health insurance, retirement plans, and other benefits.

- Work Schedule: Points out the work hours, workdays, and any flex-time options.

- Termination Conditions: Explains the process and conditions under which the employment could be terminated.

- Legal Clauses: Non-compete, confidentiality, and any other legal stipulations to protect both parties.

- Signature and date

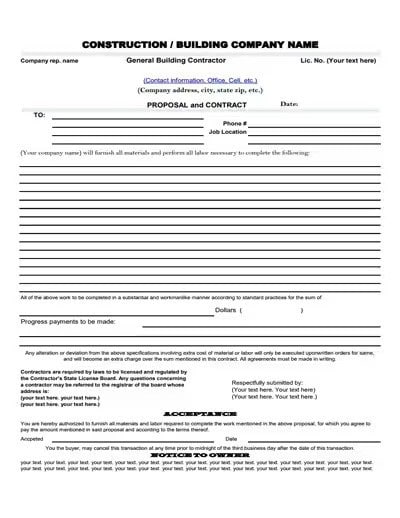

Contractor Proposal

Contractor proposals are documents that contractors use to pitch their services to get a job.

When engaging with independent contractors like in the construction and building industry, a Contractor Proposal is vital. This document describes the scope of work to be performed, terms of payment, and project deadlines. It serves as a pitch but also solidifies the expectations of both parties in a formal agreement before commencing work.

If you want your business to secure contracts as well, you’ll need them.

This document generally contains:

- Project Outline: Provides a high-level view of the project, its goals, and its expected outcome.

- Detailed Scope of Work: Lists all tasks and deliverables associated with the project.

- Pricing and Payment: Outlines the payment schedule and specifics such as milestones, deposits, and final payments.

- Project Timeline: Details deadlines and important dates for delivery of specific parts of the project.

- Contractor Information: Background information about the contractor, including relevant experience and qualifications.

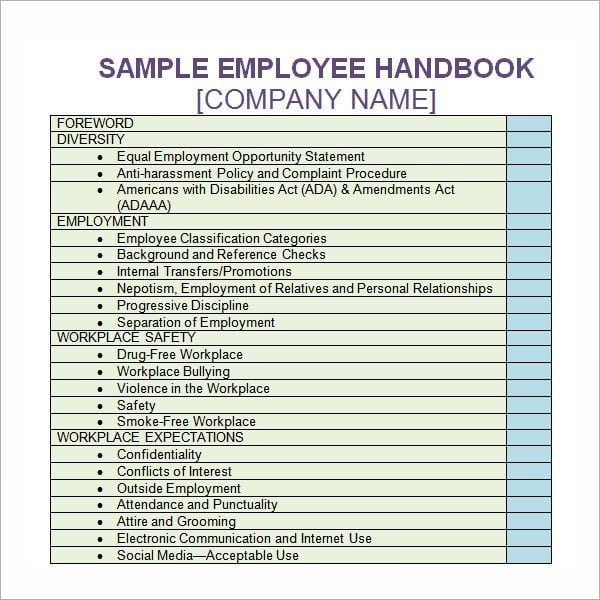

Employee Handbook

An Employee Handbook is an integral HR document that communicates company policies, culture, and expectations to its employees.

It acts as a comprehensive guide for your employees, helping them understand their rights and responsibilities within the company.

By providing a clear outline of company standards and practices, it helps foster a positive work environment and minimises disputes.

Typical Components of Employee Handbook:

- Company Overview: Information about the company’s history, mission, vision, and values.

- Employment Policies: Details on employment terms, including at-will employment, equal opportunity, and non-discrimination policies.

- Code of Conduct: Guidelines on acceptable behaviour, dress code, and workplace ethics.

- Compensation and Benefits: Information on pay structure, overtime, benefits, and bonuses.

- Leave Policies: Details on vacation, sick leave, parental leave, and other types of leave.

- Health and Safety: Procedures and policies related to workplace safety and health standards.

- Disciplinary Procedures: Steps and actions that will be taken in case of policy violations.

- Acknowledgment: A section for employees to sign, acknowledging that they have read and understood the handbook.

Sales & Marketing

Sales and marketing are crucial for attracting attention to your business, sparking interest in your products or services, generating leads, and closing sales.

Developing business documents to oversee your sales and marketing activities provides clear direction, sets timelines, measures outcomes, and boosts ROI.

Here are four essential documents you’ll need:

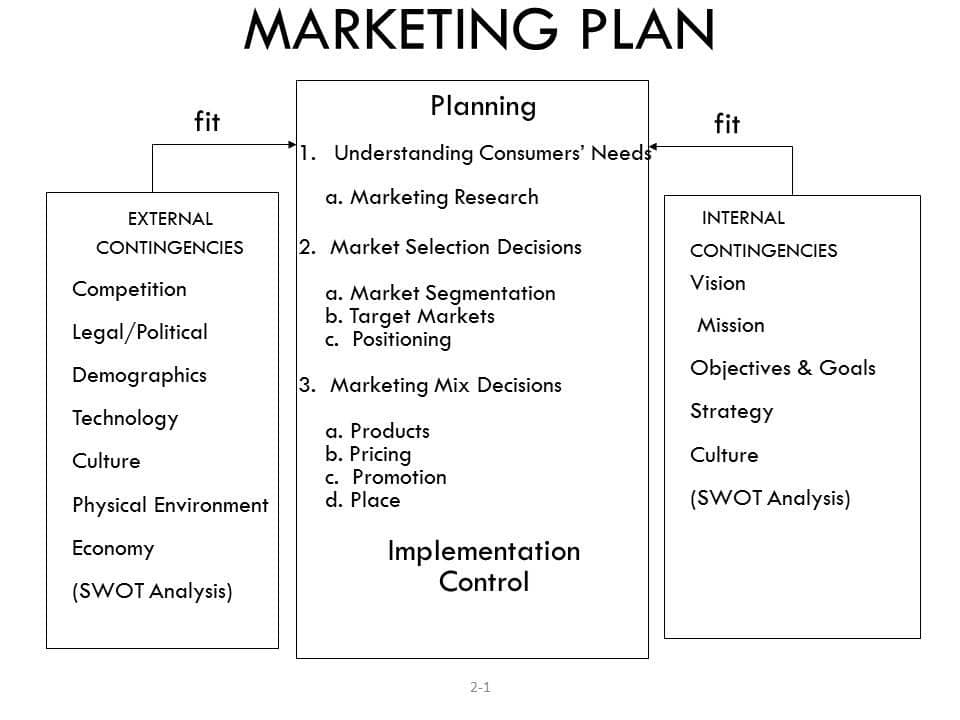

Marketing Plan

The Marketing Plan is a comprehensive document outlining an organisation’s advertising and marketing efforts for the coming year.

It serves as a roadmap, detailing strategies to achieve business objectives such as increasing market share, launching new products, or entering new markets.

A marketing plan clarifies business objectives, sets achievable expectations, and ensures team alignment.

Typically, a marketing plan includes:

- Executive summary

- Mission statement

- SWOT analysis

- Market research

- Market strategy

- Goals

- Budget

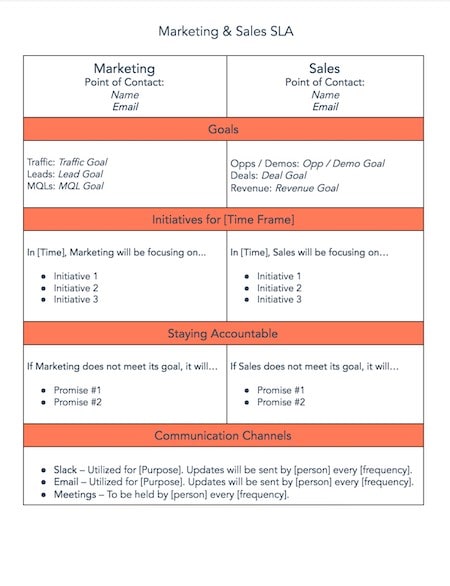

Sales Plan

The Sales Plan outlines a strategy for achieving sales targets within a specified timeframe. It’s similar to a traditional business plan, but its sole focus is your sales strategy.

It translates the broader marketing strategies into actionable sales initiatives, providing a clear pathway for the sales team to follow.

A sales plan outlines details about target customers, past performance analysis, sales tactics, revenue objectives, team structure, potential obstacles, and other crucial data necessary for creating a robust sales strategy.

A sales plan is essential because achieving specific sales targets requires a detailed, step-by-step approach.

Key elements of the sales plan include:

- Sales Goals: Quantitative targets that tie back to broader business objectives.

- Target Customers: Identification of specific markets or customer segments.

- Sales Tactics: Detailed methods and approaches to reach and convert the target customers.

- Tools and Resources: Overview of technologies, software, or materials needed.

- Performance Metrics: Criteria for measuring the success and efficiency of sales efforts.

Marketing Presentation / Pitch Deck

A Marketing Presentation or Pitch Deck communicates marketing strategies and campaigns to stakeholders, whether internal teams or potential investors. This document converts complex strategies into digestible information through compelling storytelling and visuals.

It usually includes information about the company, its unique value proposition, target market, marketing plans, and key metrics.

Typically, this includes:

- Introductory Overview: Brief insight into the current market position and company objectives.

- Marketing Strategy: Highlight major marketing initiatives and their justification based on market research.

- Campaign Examples: Visuals and descriptions of proposed marketing materials or past successful campaigns.

- Expected Outcomes: Projections on the impact of marketing efforts on sales, market share, and brand awareness.

- Budget and Timeline: Presentation of the financial and chronological aspects of the marketing plan.

A powerful presentation not only secures buy-in from stakeholders but also ensures clarity and excitement about the direction and potential impact of your marketing efforts.

Vision Statement

Although brief, the vision statement is a foundational document that captures the essence of a company’s aspirations and the overarching goal of all efforts. It serves as a guiding light for the company’s direction and helps align the efforts of its employees toward a common goal.

A vision statement answers the question: “What do we want our company to become in the future?”

Here’s an example of a vision statement:

“To be the world’s most customer-centric company, where customers can find and discover anything they might want to buy online.” – Amazon

Some key characteristics of an effective vision statement:

- Focuses on the future: A vision statement should describe what the company wants to achieve in the long term, not just the immediate future.

- Inspiring and motivating: The statement should be aspirational and motivate employees to achieve the company’s goals.

- Concise and memorable: A good vision statement is usually short, simple, and easy to remember.

- Unique and specific: The statement should reflect the company’s unique identity and differentiate it from competitors.

- Aligned with company values: The vision statement should be consistent with the company’s core values and mission.

A clear vision statement can help you make better decisions, prioritise your resources, and focus on your long-term objectives.

Wordsmith. Caffeine enthusiast. A full-time business-oriented writer with a knack for turning the ordinary into extraordinary. When not working, you can find Ishan listening to music, reading or playing with doggos.