Raising funds is an inevitable part of a startup’s journey. Entrepreneurs must go through several funding rounds to raise the necessary funds for expanding their operations.

A startup needs to raise funds at the right time; before it’s too late to join because of competition or too early to hamper the product-market fit.

The main issue arises when a startup can no longer run on a bootstrap model, meaning that the founder can no longer use their existing resources in the business. They have to look for investors, venture capitalists or incubators to invest in their businesses.

But before all that, the founder needs to determine how much funds they need. This is where the process of startup valuation comes in.

However, you have to ensure that your startup doesn’t end up getting overvalued or undervalued, as it will negatively impact the investors.

To avoid this, here are some startup valuation methods to help you in this process.

Startup Valuation Terminologies

Before moving on, here are some key terms you need to understand:

- Startup valuation: The value of a startup simply means what the startup will be worth if it’s sold today for IPO or to any other firm. It considers factors like the team’s expertise, product, assets, competition, market opportunities, and growth potential.

- Pre-money valuation: The pre-money valuation simply refers to the company’s value before any investment.

- Post-money valuation: The post-money valuation refers to the company’s value after raising funds. Simply put, pre-money valuation plus the amount of investment is the post-money valuation.

- Venture capitalists: Venture capitalists are private investors that buy a portion of a company in exchange for capital (money). These companies can be startups or small companies with high growth potential in the future. They are generally a part of a VC firm that has an investment fund dedicated to financing businesses.

- Pre-revenue startups: A company that is at a prototype stage or has launched its first product in the market but has not actually made any money from selling its product or service.

- EBITDA: Earnings before Interest, Tax, Depreciation, and Amortisation

- Angel investors: Angels are wealthy private investors who invest in small businesses or startups in exchange for a stake in their business. Unlike VC firms, angel investors use their own net worth for investing.

For Pre-Revenue Startups

Most startups don’t have concrete earnings at the beginning of their life cycle. As a result, it becomes difficult to value startups without any financial data. But, founders of pre-revenue startups still need to ascertain the value of their company when raising funds.

So here are a few different startup valuation methods used by entrepreneurs when they are pre-revenue.

The Berkus Method

The Berkus method calculates the value of a startup before it generates its first revenue. Instead of financial estimates, it focuses on the risks connected with the company.

Founders of startups frequently expect rapid sales growth and unrealistic profit margins, which they are unable to meet.

As a result, Dave Berkus created this model to value a startup based on its potential instead of actual performance.

Under this startup valuation method, your startup is assessed based on five key success factors associated with major risks that can make or break a startup. These are

- Sound idea – It represents a business’s basic value, indicating that it has a good startup idea.

- Prototype – Technology risk is reduced if a company has a product that attracts customers.

- Strategic relationships – Strong strategic alliances and partners reduce the market risk of a startup.

- Quality management – An excellent management team reduces the risk of poor implementation.

- Product roll-out or sales – Production risk is reduced when a company has strong signs of revenue growth in the future.

Each factor is assessed and assigned a monetary value ranging from zero to $500,000. The sum of all five values is a startup’s pre-money valuation, which can go up to $2 million – $2.5 million under this method.

Let’s understand this with an example:

Value driver | Assigned value (Maximum $500,000) |

|---|---|

Sound Idea | $300,000 |

Prototype | $275,000 |

Strategic relationships | $175,000 |

Quality management | $350,000 |

Product roll-out or sales | $200,000 |

PRE-MONEY VALUATION (SUM) | $1,300,000 |

Even if you have a good business idea ($300,000), your startup requires an excellent implementation team to succeed. Now if you have a team of domain experts and professionals on board, so the highest monetary value is assigned to quality management ($350,000).

The sound technology used makes the prototype marketable ($275,000) and shows promise of generating revenue in the future ($200,000). As a result, your company will be valued at $1.3 million.

Cost To Duplicate

As the name implies, the cost to duplicate approach determines the cost of building the same startup from scratch.

Every expense from the cost of building a product to purchasing physical assets is considered. The sum of all these expenses is the “fair market value” of the business.

The rationale is that a potential investor would not allow a higher valuation of the business than its fair market value.

If you have a SaaS startup, for example, it will be valued at the overall cost of developing the software. For a high-tech startup, the costs could be incurred in research and development, filing patents, and product engineering.

By concentrating solely on a company’s physical assets, this approach largely ignores intangible assets like human capital, intellectual property, or brand value. This is a major drawback as intangible assets are an important source of competitive advantage and are often described as a company’s lifeblood.

Another flaw with this startup valuation method is that the startup value remains unaffected by the company’s future potential to generate revenue, profits, and higher growth rates.

The cost-to-duplicate approach is often seen as a starting point in valuing startups as it is merely a record of historic expenses. You can combine this with other approaches like the Berkus method or Scorecard valuation to achieve better results.

Discounted Cash Flow Model

The discounted cash flow model refers to a valuation method that determines the value of a startup based on its future cash flows.

It is one of the most widely used methods that consider the time value of money. This simply means that a dollar is worth more today than a year from now because it can be invested.

For example, with a 10% annual interest rate, $1 in a savings account will be worth $1.10 after one year, $1.21 in 2 years, and so on.

The projected future cash flows are then discounted with a fixed rate to determine their present value.

The sum of all discounted cash flows for the period is termed the startup’s value.

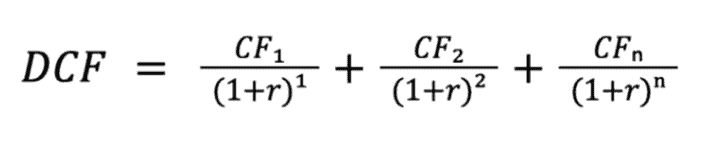

The formula for the DCF valuation method is:

Where CF1 = Cash flow of year 1

CF2 = Cash flow of year 2

CFn = Cash flow of year ‘n’

n = number of periods

r = discount rate

Cash flow refers to the net amount of cash and cash equivalents moving in and out of business. For valuing a startup, we take free cash flows, which refer to earnings (including interest) net of taxes

The number of periods is the number of years cash flows are expected to occur.

The discount rate is usually taken as the weighted average cost of capital (WACC) or cost of capital. WACC refers to the return expected by the providers of capital.

Let’s understand this method with the help of an example:

Suppose your company A Ltd. is evaluating a new project. Your company’s WACC is 10% hence the discounting rate. The project has the following cash inflows for the next five years along with the initial investment of $1 million.

Consider the long-term growth rate to be 15%.

So terminal cash flow is calculated for the period after five years as follows

Free cash flow after Year 5 = Free cash for the last period (Year 5) * (1 + growth rate)

Year | Cash flow (in $) | Discounting factor (10%) | Discounted Cash flow (in $) |

|---|---|---|---|

1 | 100,000 | 0.909 | 90,909 |

2 | 200,000 | 0.826 | 165,289 |

3 | 300,000 | 0.751 | 225,394 |

4 | 400,000 | 0.683 | 273,205 |

5 | 500,000 | 0.621 | 310,460 |

5 | 575,000 (terminal cash flow) | 0.621 | 357,075 |

The sum of discounted cash flows | 1,422,332 |

Hence the value of the startup, in this case, is $1,422,332

Scorecard Valuation

Formulated by Bill Payne, the scorecard valuation is one of the most popular methods used by angels.

Like the Berkus method, the scorecard method doesn’t rely on financial projections but compares other funded startups in the same region with added criteria.

First, you determine the pre-money valuation of the company. Then, you’ll compare where your company stands on the following parameters.

- Strength of the Management Team (0-30%)

- Size of the Opportunity (0-25%)

- Product/ Technology (0-15%)

- Competitive Environment (0-10%)

- Marketing/ Sales Channels/ Partnerships (0-10%)

- Need for additional investment (0-5%)

- Other (0-5%)

Now let’s take an example to understand this startup valuation method better.

Suppose your company X Ltd is looking to raise funds.

The first thing you do is find the average pre-money valuation of comparable companies. Say, you found pre-money valuations of three companies:

A Ltd | $3,500,000 |

B Ltd | $5,000,000 |

C Ltd | $3,500,000 |

Average pre-money valuation | $4,000,000 |

Now, you have to adjust this valuation based on some attributes. This is how we find the adjustment factor.

Attribute | Range | Actual weight (X) | Target company (X Ltd) (Y) | Factor (X*Y) |

|---|---|---|---|---|

Strength of the management | 0-30% | 20% | 100% | 0.2 |

Opportunity size | 0-25% | 15% | 60% | 0.09 |

Product/ technology | 0-15% | 15% | 130% | 0.195 |

Competitive Environment | 0-10% | 10% | 150% | 0.15 |

Marketing/ Sales Channel/ Partnerships | 0-10% | 5% | 75% | 0.0375 |

Need for additional investment | 0-5% | 5% | 100% | 0.05 |

Other | 0-5% | 0% | 80% | 0 |

Adjustment factor | 0.7225 |

The actual weight you assign to each parameter is subjective to your judgments. For example, if you believe the management team is not strong enough, its weight can be lowered to 20%. If you think there is a lot of competition in the market then the weight can be 10%.

The target company’s impact is assessed based on a worksheet which is a list of various issues and their impact.

The adjustment factor (0.7225) is multiplied by the average pre-money valuation ($4,000,000).

This gives the target company’s pre-money valuation to be $2,890,000.

Venture Capital Method

Venture capital firms invest in startups by buying a portion of the company in exchange for money. They use startup valuation to determine how much of a company they should buy.

In the absence of positive cash flows or good comparable companies in the market, it becomes difficult to establish the value of a company.

As a result, Bill Sahlman introduced the venture capital method of startup valuation that focuses on the Exit Value (EV) or Terminal Value (TV), which is the value at which the company is expected to be sold at a future time.

Let’s understand the process with an example.

You are looking to raise $5 million as an investment for your startup.

First, determine the company’s financial forecasts including projected sales, EBITDA, and Net Profit.

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

Revenue | $1M | $10M | $30M | $55M | $100M |

EBITDA | $0.5M | $2M | $5M | $15M | $20M |

Net income | $0M | $1M | $3M | $6M | $10M |

Now, let’s say that the Venture Capital firm wants to exit by Year 5. This implies that the Exit Value will be calculated at Year 5.

The comparable companies in the market are trading for 10 times their earnings (net income)

Exit Value (EV) = Net Income x Multiple

EV = $10M x 10 times = $100M

Now, you discount the exit value with a rate equal to the desired rate of return of VC investors to reach a Present Value (PV).

Rate of return expected = 33%

Using the DCF formula

PV = $100M / (1 + 33%)^5 = $24M

This present value of $24M is the company’s post-money valuation.

Now subtract the initial investment of $5M to get the pre-money valuation.

So the pre-money valuation will be $19M.

To calculate the ownership stake of VC

Amount of initial investment / post-money valuation

$5M / $24M = 20.83%

Risk Factor Summation

The risk factor summation or the RFS method is a pre-money valuation method for early-stage or pre-revenue startups.

Like the scorecard valuation, the RFS method begins with a base value which is the pre-money valuation of a company computed on the basis of comparable startups.

This base value is then adjusted for 12 standard risk factors.

Simply put, you compare your startup to similar startups in the market and judge whether you have a higher or lower risk.

Each of these risks is assigned a score within the range [-2,2] depending on its severity.

Rating | Risk | Adjustment to Pre-money valuation |

|---|---|---|

+2 | Extremely Positive | Add $500,000 |

+1 | Positive | Add $250,000 |

0 | Neutral | Add/ Minus Nothing |

-1 | Negative | Minus $250,000 |

-2 | Extremely Negative | Minus $500,000 |

You will understand this better with the help of an example.

Suppose you are looking to raise funds for your startup FabFood Ltd from the market.

You start by determining a benchmark value which is computed by taking the average of the valuations of comparable startups in your area.

Name | Valuation |

|---|---|

ABC Foods Ltd. | $4M |

XYZ Edibles | $3.5M |

PQR Ltd | $6M |

Spoodle Ltd | $2.5M |

Average pre-money valuation | $4M |

This value will be the benchmark value which will be adjusted for the following risk factors.

Risk Factor | Rating |

|---|---|

Risk of the Management | 1 |

Stage of the Business | 2 |

Exit Value/ Potential lucrative exit risk | 0 |

Risk of reputation | -1 |

Supply chain risk | -2 |

Political risk | 0 |

Funding/ Capital raising risk | 1 |

Sales and marketing risk | 1 |

Competition risk | -1 |

Technology risk | 1 |

Litigation risk | 0 |

International risk | 2 |

Sum | 4 |

You now multiply this number by $250,000 to arrive at the adjustment value.

Risk adjustment = 4 x $250,000 = $1 million

So, the total pre-money valuation of your startup is $4 million + $1 million = $5 million.

For Post-Revenue Startups

Startups that have made some money by selling their product or service in the market are known as post-revenue startups. They have concrete financial data which can be compared with other companies in the same industry to ascertain their valuation.

So let’s understand a few startup valuation methods used by post-revenue startups:

Standard Earnings Multiple Method

A multiple of earnings is a valuation approach in which the value of a firm is established by multiplying its earnings by a multiple.

For example, if a firm has $1 million in earnings and a multiple of 5, its valuation is $5 million.

This implies that under this strategy, two elements impact the value of your company: the company’s earnings and a multiple.

A company is valued on the basis of its operating performance over the years. As a result, most companies use EBIT (Earnings before Interest and Taxes) – operating profit – as a measure of their earnings. While sometimes, companies also use EBITDA to measure earnings.

The next step is to choose an earnings multiple. Businesses in the $1-10 million range use a multiplier of 2-4x while businesses larger than $10 million can use a multiple as high as 8 – 12x.

Many factors influence the value of the multiple.

- Industry: The most common factor is the industry in which the business operates. Small service companies tend to have a smaller multiple like 2-3x. On the other hand, software as a Service (SaaS) companies can have a multiple as high as 15x.

- Revenue trend: If the business shows a year-on-year or month-on-month growth rate in revenue, it will receive a higher multiple than a company whose revenues are decreasing.

- Company age: A well-established company with a powerful brand value and a strong customer base will have a larger multiple than a company that is just starting out. These elements take time to build and are an indication of stability thus increasing the multiple.

The simplicity of this method makes it extremely popular for startup valuation. Another major factor is that most startup valuation methods are for pre-revenue startups, but this method gives a way to calculate it for startups who have some level of earnings.

Market Multiples Method

The market multiples approach is a startup valuation method based on the principle that similar companies in the same industry should have a similar value.

To use this method, an investor or analyst of the company identifies a group of comparable companies and gathers data on their financial performance and metrics like revenue, earnings, and cash flow.

Based on the metrics gathered, various financial ratios are calculated. An average or median of these ratios are then used to determine the multiple for valuing your startup.

Let’s understand this better with the help of an example.

Suppose you have an e-commerce startup – A Ltd.

The first step is to collect financial data of all comparable companies in the industry:

Company | Revenue | Net Income | EBITDA |

|---|---|---|---|

P Ltd | $100M | $20M | $30M |

Q Ltd | $50M | $5M | $7M |

R Ltd | $10M | $2M | $1M |

S Ltd | $75M | $6M | $8M |

Next, you calculate financial ratios as follows

Company | Price-Sales Ratio (P/S Ratio) | Price-Earnings Ratio (P/E ratio) | Price EBITDA ratio |

|---|---|---|---|

P Ltd | 8x | 40x | 26.67x |

Q Ltd | 2.5x | 25x | 17.85x |

R Ltd | 2x | 10x | 20x |

S Ltd | 1.2x | 15x | 11.25x |

Now, to determine the market multiple, you have to take the median or average of financial metrics.

Let’s take the average of the P/S ratios of all comparable companies.

Average P/E ratio = (8x+2.5x+2x+1.2x) / 4 = 3.425x (market multiple)

The estimated value of your startup is calculated as follows:

Startup value = Revenue x market multiple

If the revenue of your startup is $15M then your startup valuation will be

$15M x 3.425 = $51.375 Million.

Book Value Method

The book value method of startup valuation is a method where the value of a company is determined by taking the net value of its assets and liabilities.

Companies can use this startup valuation method at any stage of their life cycle.

Effectively, this method is based on the company’s balance sheet, where its value is calculated by subtracting the value of liabilities from the assets. This is also known as the net worth of the business.

Let’s illustrate this with the help of an example:

Suppose you have a startup that manufactures sustainable utensils for households. This is your financial information:

Liabilities | Amount | Assets | Amount |

|---|---|---|---|

Capital | $1,000,000 | Plant & Machinery | $500,000 |

Creditors | $450,000 | Debtors | $550,000 |

Cash | $400,000 | ||

Total | $1,450,000 | Total | $1,450,000 |

Now net worth or book value of your company is calculated as

Book Value = Total assets – Outside liabilities

Book Value = $1,450,000 – $450,000

Book Value = $1,000,000

Capital in your business is not an outside liability because it represents your (owner’s) ownership in the company.

However, this method may not accurately reflect the true value of a startup. Financial statements frequently fail to represent elements like intellectual property, brand identity, and management team quality. This strategy does not consider a company’s revenue forecasts and future growth potential.

So it is best advised to pair this with other startup valuation methods to arrive at a more accurate valuation.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on startup valuation methods in the comments section.

A startup enthusiast, optimist and full time learner. With keen interest in finance and management, Khushi believes communication to be the key to every management. Always ready to explore more and walking that extra mile in putting efforts.