Being a great business owner doesn’t make you a great financial manager—but you can’t run a business on passion alone.

Over half of small businesses fail within their first five years—primarily due to financial mismanagement—so understanding your finances is crucial for your business’s success.

Having a financial management plan is essential as it acts as a strategic road map to help your business achieve its goals.

When you understand your business’s financial obligations, track your recurring expenses, understand your revenue streams, and mark critical financial dates, you can better plan for the future and operate your business more smoothly. This foresight helps prevent avoidable obstacles as you grow.

This comprehensive guide will provide you with all the necessary knowledge to manage your small business finances.

Financing Terms That You Should Know

First and foremost, you need to understand the essential financing terms that form the foundation of managing small business finances.

Term | Definition |

|---|---|

Cash Flow | The total amount of money being transferred into and out of a business, especially as affecting liquidity. |

Working Capital | The capital of a business, which is used in its day-to-day trading operations, is calculated as current assets minus current liabilities. |

Profit Margin | A measure of profitability is calculated as net income divided by revenue, expressed as a percentage. |

Break-Even Point | The point at which total cost and total revenue are equal, meaning there is no net loss or gain. |

Accounts Receivable | The balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. |

Accounts Payable | The amount of money a company owes to its suppliers for goods and services purchased on credit. |

Debt-to-Equity Ratio | A measure of a company’s financial leverage is calculated by dividing total liabilities by equity. |

Interest Rate | The amount charged by a lender to a borrower, expressed as a percentage of the principal, for the use of assets. |

Collateral | An asset that a lender accepts as security for extending a loan. |

Depreciation | The decrease in the value of an asset over time, due in particular to wear and tear or the decline in price of the asset. |

Cash Burn Rate | The rate at which a company uses up its cash reserves or cash balance. |

Return on Investment (ROI) | A performance measure is used to evaluate the efficiency or profitability of an investment. |

Gross Revenue | The total income generated by a business before any expenses are deducted |

Necessary Documents For Small Business Finance

Now that you have a foundational understanding of basic financing terms, it’s important to familiarise yourself with the key documents that play a pivotal role in managing small business finances effectively.

Business Plan

While not a “financial document” in the traditional sense, your business plan is foundational, as it outlines your business goals, strategies, market analysis, and financial projections. It sets the stage for financial planning and attracts investors or lenders.

Financial Statements

Financial statements are critical for understanding your business’s financial health. The three main types are:

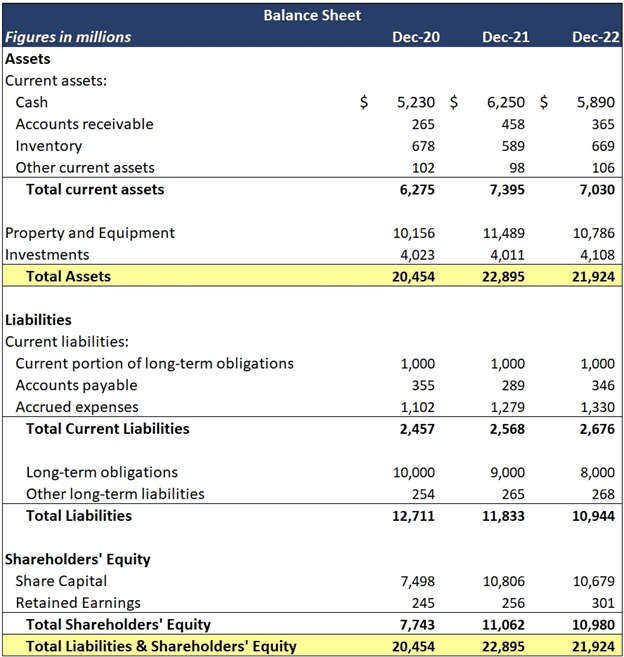

Balance Sheet

Shows your business’s assets, liabilities, and equity at a specific point in time. It provides a snapshot of what your business owns and owes, as well as the amount invested by shareholders.

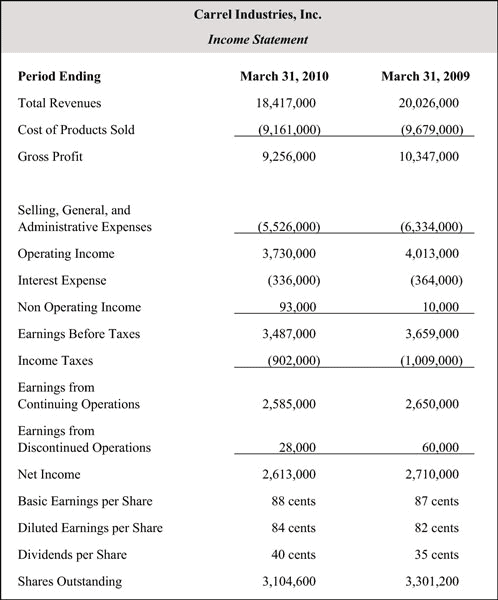

Income Statement (Profit and loss Statement)

This statement details your revenue, expenses, and profits over a specific period. It helps assess your business’s profitability and operational efficiency.

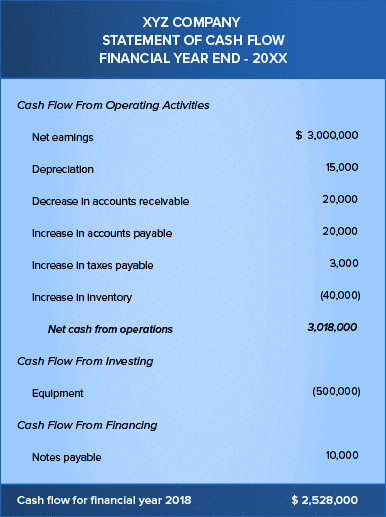

Cash Flow Statement

Tracks the flow of cash in and out of your business. It’s crucial for understanding liquidity and ensuring you have enough cash to cover day-to-day operations.

Tax Returns

Tax returns are essential documents that record your business’s income, expenses, and any tax paid to the government. They include:

- Annual Tax Returns: Filed annually to report your business income and calculate the tax owed. Keeping accurate and up-to-date tax returns is crucial for compliance and avoiding penalties.

- Quarterly Tax Filings: If your business pays estimated taxes quarterly, maintaining these records ensures you stay on track with your tax obligations.

Business Licences and Permits

Business licences and permits are required to legally operate your business. These can vary based on your industry, location, and the nature of your business activities. Key documents include:

- Local Business License: Required by your city or county to operate legally within the jurisdiction.

- Professional Licences: Specific industries, like healthcare or real estate, may require professional credentials.

- Zoning Permits: Necessary if your business operates out of a specific zone or if you run a home-based business.

Insurance Policies

Insurance policies protect your business from various risks. Essential insurance documents include:

- General Liability Insurance: Covers legal fees and damages related to accidents, injuries, and claims of negligence.

- Property Insurance: Protects your business property against risks such as theft, fire, and natural disasters.

- Workers’ Compensation Insurance: Mandatory in many regions, this covers medical expenses and lost wages for employees injured on the job.

Operational Documents

Operational documents are those that detail the day-to-day workings of your business. These include:

- Contracts and Agreements: Written agreements with suppliers, customers, and employees. They define the terms of business relationships and protect your interests in case of disputes.

- Invoices and Receipts: Records of sales and purchases. They are essential for tracking revenue, managing accounts receivable, and claiming expenses.

- Employee Records: Documentation of employment terms, payroll, and performance reviews. These are vital for human resources management and legal compliance.

Registering Your Business

Registering your business is the first step in managing your company’s finances. To do this effectively, you’ll need to decide on the business structure that best suits your needs.

Here are some of the most common types of small businesses:

Sole Proprietorship

A sole proprietorship is a simple and cost-effective business structure with a single owner. It’s easy to establish, but it doesn’t provide legal separation between the owner and the business.

The owner is personally responsible for any business debts or legal actions.

Examples include freelance writer, photographer, personal trainer, plumber, consultant, etc.

Limited Liability Company (LLC)

An LLC blends elements of sole proprietorships and corporations. It offers personal liability protection against business debts and lawsuits.

Additionally, it provides flexibility in tax filing, allowing owners to choose between being taxed as sole proprietors or corporations.

Examples include: Google LLC, IBM Credit LLC (a subsidiary of IBM) , Blockbuster LLC, RAIZE Bakery, Hertz, etc.

Corporation

A corporation is a legally recognised entity that operates independently of its owners. This structure ensures complete financial separation between the business and personal finances of its shareholders.

Corporations benefit from lower tax rates but require a more complex and costly setup process.

Examples include: Alphabet (parent company of Google), PepsiCo, Exxon Mobil, Johnson & Johnson, etc.

Opening A Business Bank Account

Once your business is registered, the next step is to open a business bank account. This is important for separating your personal and business finances, simplifying tax preparation, and presenting a professional image to clients and suppliers.

Here are the business bank accounts you should consider opening:

Business Chequing Account: It is ideal for receiving customer payments and covering company expenses such as rent and utilities.

Business Savings Account: Small Business Savings Accounts are useful for setting aside funds for tax payments and building an emergency fund for unexpected costs. By keeping your excess funds in a savings account, you can earn interest on your money and improve your business’s overall financial health.

To open a business bank account, you’ll need:

- Identification: Provide personal identification, such as a driver’s licence or passport. Ensuring your business information, such as the registration certificate, is also ready will speed up the process.

- Employer Identification Number (EIN): If your business is in the U.S., you’ll need an EIN from the IRS. This number is like a Social Security number for your business and is used for tax purposes.

- Business Licences: Include any state or local business licences or permits that demonstrate your right to operate.

Picking An Accounting Method

Two basic accounting methods—cash-based accounting and accrual-based accounting—can help you keep track of your finances.

You’ll want to choose the method that works best for you and stick with it:

Cash-Based Accounting

In cash-based accounting, transactions are recorded only when cash changes hands. You record income when you receive payment and expenses when you pay them out.

This method is straightforward, making it appealing for many small businesses, particularly those that don’t have inventory, operate on a cash basis, or require simpler accounting processes.

You only pay taxes on money received, which can be advantageous if your business has fluctuating income.

However, cash-basis accounting may not accurately represent your business’s financial position, especially if you have significant accounts receivable or payable.

It’s ideal for small businesses that primarily deal in cash transactions and have minimal inventory, such as freelancers or consultants.

Accrual-Based Accounting

Accrual-based accounting records transactions when they are earned or incurred, regardless of when cash is exchanged. This method provides a more accurate financial picture of your business.

It is required by generally accepted accounting principles (GAAP) for businesses with over $25 million in annual sales, making it necessary for larger small businesses or those planning to grow.

While accrual accounting offers a more accurate picture, managing it can be more challenging and may require professional assistance.

It suits larger businesses or those with significant inventory and credit transactions.

Choosing A Bookkeeping Solution

Bookkeeping may seem daunting, but it simply involves recording all your income and expenses. Developing a consistent bookkeeping method that works for you is a good idea.

You can choose between single-entry or double-entry bookkeeping to manage your financial records effectively.

The right choice for your business depends on several factors, including the complexity of your financial transactions, budget, and personal management style.

- Manual Bookkeeping Systems: It is Ideal for very small or start-up businesses with a straightforward financial structure. This cost-effective solution requires a good understanding of basic accounting principles and is more time-consuming and prone to human error.

- Spreadsheet Software: Tools like Microsoft Excel or Google Sheets offer a step up from manual systems, providing a digital means to organise your finances. While this method is still labour-intensive, it introduces greater accuracy and the ability to use formulas to automate some calculations.

- Bookkeeping Software: Dedicated bookkeeping software, such as QuickBooks, Xero, or FreshBooks, offers comprehensive features that streamline the accounting process. These applications can automate many aspects of bookkeeping, including invoicing, bill payment, tax preparation, and financial reporting. They often offer cloud-based access for easy collaboration with your accountant or team.

- outsourced bookkeeping services: For businesses that prefer to focus on operations rather than accounting, outsourced bookkeeping services provide a hands-off approach. These services handle all aspects of your business finances, from transaction entry to preparing financial statements, often using sophisticated software tools.

Small Business Accounting Software

Manually managing your accounting documents can quickly become overwhelming.

Thankfully, there are several great accounting software options available that will take the guesswork out of your bookkeeping.

With these cloud-based services, you can access your most crucial accounting documents with just a few clicks, automatically generate them, and efficiently handle invoicing and other bookkeeping tasks.

Tools | QuickBooks | Xero | FreshBooks | Float | Pulse |

|---|---|---|---|---|---|

Features/Tools | Comprehensive accounting software with strong bookkeeping features | Online accounting software for small businesses and accountants | Cloud-based accounting software targeting freelancers and agencies | Cash flow forecasting and management tool | Cash flow forecasting tool focusing on scenarios and planning |

Core Focus | Yes | Yes | Yes | N/A | N/A |

Automated Invoicing | Automated bill payment capabilities | Automated bill payments with scheduling options | Simplified expense tracking and vendor payments | N/A | N/A |

Bill Payments | Yes | Yes | Yes | Limited real-time insights tied to cash flow | Limited to cash flow insights |

Real-time Financial Reporting | Basic forecasting through reports and insights | Offers cash flow forecasting through reports and integrations | Basic forecasting abilities through financial reports | Advanced forecasting with scenario planning | Advanced scenario planning and forecasting |

Cash Flow Forecasting | Wide range of integrations with other business and financial services | Extensive app marketplace for additional tools and services | Integrates with several external tools and services | Integrates with Xero and QuickBooks for seamless data import | Limited integration focusing on cash flow scenarios |

Integration | User-friendly interface with extensive resources for help | Known for its ease of use and clean interface | It has an easy-to-use platform aimed at non-accountants | User-friendly with a focus on visual cash flow management | Visual and intuitive to help with planning and forecasts |

Usability | Small to medium-sized businesses | Small to medium-sized businesses across various industries | Freelancers, agencies, and small businesses | Businesses of all sizes looking to manage and forecast cash flow | Small to medium-sized businesses focused on cash flow planning |

Managing And Tracking Cash Flow

Cash flow is the lifeblood of any small business.

It refers to the movement of money in and out of your business and is a critical determinant of its financial health. Properly managing and tracking cash flow ensures your business has enough funds for daily operations, growth investments, and emergencies.

Positive Cash Flow

Maintaining positive cash flow—where your income exceeds your expenses—is essential for staying in business. Positive cash flow ensures your ability to pay bills on time and handle unexpected costs.

Negative Cash Flow

At times, you might encounter negative cash flow, such as when investing in new equipment or awaiting overdue customer payments. In these situations, you might need to use a bank overdraft or short-term loan to cover the gap.

It shouldn’t pose a significant issue as long as you have planned for this and can return to a positive cash flow.

Cash flow is usually tracked over standard reporting periods like a month, quarter, or year.

Why Does Cash Flow Matter for Your Small Business?

According to research cited by SCORE and U.S. Bank, 82% of small business failures are due to poor cash flow management or a poor understanding of cash flow. Businesses that run out of cash are likely to fail, even if they are profitable on paper.

Managing cash flow during the initial stages of your business can be particularly challenging.

Early expenses often surpass incoming revenue as your client base is still developing. It’s important to evaluate your cash flow from the outset and secure temporary financial resources, such as savings or overdrafts, to maintain operations until your revenue streams are established.

Therefore, keeping a close eye on your cash flow is crucial to the success of your small business.

Choosing Your Payment Methods

To get compensated for your work, you need to choose the payment methods you’ll accept from customers.

It’s essential to balance meeting your customers’ diverse preferences and keeping payment processing affordable and easy to manage.

Here are some common payment methods for small businesses:

- Cash: Cash handling is straightforward and typically free of processing fees, but it’s not without risks, like theft or accounting errors. Moreover, cash only works for in-person transactions and doesn’t fit well with the growing trend of online shopping.

- Credit and Debit Cards: Accepting cards can attract more customers, providing convenience and security. However, businesses need to consider the fees associated with card processing and ensure compliance with Payment Card Industry Data Security Standards (PCI DSS).

- Online Payments: Services like PayPal, Stripe, and Square offer solutions for online transactions with varying fee structures. They’re crucial for e-commerce and can be convenient for service-based businesses invoicing digitally.

- Mobile Payments: With the rise of mobile wallets like Apple Pay and Google Pay, offering mobile payment options can enhance the customer experience, especially for a younger, tech-savvy demographic.

- Bank Transfers: Direct bank transfers, including ACH and wire transfers, are a cost-effective method for B2B transactions, recurring payments, and handling large sums.

- Checks: While declining in popularity, checks can still be used for business transactions, especially in industries like Construction, real estate, and government contractors that prefer a paper trail for accounting purposes.

- Cryptocurrency: Though not yet mainstream, cryptocurrency is an emerging payment method that some businesses are exploring to cater to niche markets and international customers.

Setting Up Payroll

When your business employs staff or contract workers, setting up a payroll system is essential for processing their salaries or wages.

The first step in this process is to classify your workers accurately. This classification directly impacts your tax responsibilities, making it an important task.

Here are the key differences between an employee and a contractor:

- Employees are individuals over whom your company controls their work activities. Your business determines their work hours, sets their wages or salary, provides necessary training, and retains the authority to hire or terminate them.

- Contractors, on the other hand, are independent workers who have the liberty to decide how, when, and where they work. They usually bill by the hour or per project and have the flexibility to set their own work schedules.

Collect required documentation from all employees, including W-4 forms for tax withholding, I-9 forms for employment eligibility verification, and any state-required forms.

Choose A Payroll System

Manual Payroll

Handling payroll manually involves using spreadsheets and tax tables to calculate wages and deductions. While this method is less expensive upfront, it can be time-consuming and prone to errors.

Manual payroll is suitable for businesses with a very small team and those who are well-versed in payroll calculations and tax regulations.

Payroll Software

Feature | Gusto | Zil Money | Zoho Payroll |

|---|---|---|---|

Payroll Processing | Automatic payroll calculations, tax filings, and payments | Personalised payroll check printing, bank reconciliation | Automated payroll calculations, tax compliance |

HR Management | Onboarding, benefits administration, time tracking | Vendor management, invoice handling, payment methods | Employee self-service portal, attendance tracking |

Accounting Integration | Seamless sync with QuickBooks, Xero, and others | Connects to 22,000+ banks, integrates with accounting software | Integrates with Zoho Books for accounting automation |

Compliance | Handles federal, state, and local tax filings | Positive pay features to prevent fraud | Stays up-to-date with tax law changes |

Reporting | Customisable payroll reports, employee data analytics | Real-time cash flow visibility, transaction tracking | Comprehensive payroll and HR reports |

Payroll software can significantly streamline the payroll process by automating calculations and ensuring compliance with tax laws.

These tools calculate wages, deduct the appropriate taxes, and often offer direct deposit services to simplify payments.

Payroll Service Providers

Outsourcing payroll to a third-party provider can be an excellent solution for reducing time and ensuring compliance with complex tax regulations.

Payroll service providers manage all aspects of payroll, including wage calculations, tax filings, and direct deposits. They also keep up with the latest tax laws and regulations, minimising the risk of penalties due to non-compliance.

Some providers offer additional services, such as managing employee benefits and handling payroll-related inquiries, allowing you to focus on other critical aspects of your business.

Determining Your Tax Obligations

Tax Obligation | Description |

|---|---|

Income Tax | All businesses, except partnerships, must file an annual federal income tax return. The specific tax return form depends on the business structure (sole proprietorship, partnership, corporation, etc.). |

Self-Employment Tax | Sole proprietors and partners are subject to self-employment tax for Social Security and Medicare contributions. |

Employment Taxes | Businesses with employees must pay employment taxes, which cover federal income tax withholding, Social Security, and Medicare contributions, as well as federal unemployment (FUTA) taxes. |

Estimated Taxes | Sole proprietors, corporations, S corporations, partners, and shareholders need to make quarterly estimated tax payments throughout the year. |

Sales Tax | Most states and localities impose a sales tax that businesses must collect from customers and remit to the appropriate tax authorities. |

Other State and Local Taxes | Depending on the business location, there may be additional state and local taxes such as income tax, property tax, franchise tax, or business licence fees. |

Failing to understand and meet your tax obligations can result in significant penalties and interest, harming your business’s financial stability.

The taxes you owe are influenced by the nature of your business and your location. You’ll need to do some research to determine all your company’s tax requirements, but these are some of the common tax obligations for small businesses:

- Business or professional income tax

- Corporate income tax

- GST / HST

- Payroll deductions

Consulting A Professional

If managing your business finances feels overwhelming or if you’re launching a new business and want to start on solid financial ground, consulting an accountant is a wise choice. A Certified Public Accountant (CPA) can assist you with a variety of financial tasks, including:

- Choosing the Legal Structure: Helping you determine your business’s most suitable legal structure.

- Business Insurance: Advise you on the types of insurance coverage you need.

- Financial Strategy: Creating a comprehensive financial plan tailored to your business goals.

- Tax Compliance: Ensuring you meet all tax obligations and helping you file tax returns accurately.

- Financial Reporting: Producing detailed financial reports to monitor your business’s performance.

Understanding your business finances provides a clear view of your company’s financial health and informs critical decisions, such as hiring staff or investing in new equipment. Mastering the basics of small business accounting positions you for future growth and success.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.