Imagine this scenario: you want to buy a product from an e-commerce website, but after researching for the best product that fits your needs, you just put it in your wishlist/cart and don’t check out. A couple of minutes later, you find advertisements on your social media of the exact same product; you click on it, but the product has a different price now. Sounds familiar? Well, this smart pricing strategy is dynamic pricing.

What Is Dynamic Pricing?

Dynamic pricing (also called real-time pricing, surge pricing, or time-based pricing) is a technique that focuses on setting the price of the product according to its demand and supply but in a smaller time frame. The other factors that are taken into consideration are competitor pricing, the perception of the customer, and the brand value.

Speaking in terms of money, it basically is the price set by the vendor (typically online) that it perceives the client will be able to pay for the service provided.

The Math Behind Dynamic Pricing

The Math behind dynamic pricing is quite simple. It is a game of markup pricing (Basically, the profit margin from a single product that you sell). Depending upon the market, the markup percentage varies.

Now since there are multiple price points in dynamic pricing, the resolution of pricing is higher and a product can be priced accordingly to gain maximum profit.

Further, to find out how much you can vary the markup of your products, you need to keep in mind the market you are competing in:

For a monopolistic market (a market scenario where one single firm dominates sales), the markup percentage can be as high as 1000%. Since no competitor has a role on the pricing, pricing in monopolistic markets can be the most dynamic based solely upon the market demands.

For an oligopolistic market (a market where a few firms dominate the sales), the markup percentage is high too however, the pricing depends upon the decisions taken by one of the firms. Thus, pricing of competitors plays a huge role in an oligopolistic market. Examples: Airlines.

For a perfect competition (a market where a number of firms are competing for market share), the markup percentage is very less as these firms are fighting off competition to win market share and thus dynamic pricing hardly takes place in such markets. Example: Most FMCG (Fast moving consumer goods).

Now we know why dynamic pricing exists in the first place. It is because markup percentage can be varied to get the maximum number of customers.

Bottom line: You cannot fix a strict price and stick to it. A vendor calculates the fixed cost and variable cost and sells according to a suitable markup depending on the customer perception. That is the best strategy to gain maximum revenue.

The question you probably are interested in is: How does a vendor decide whether to hike price or not?

The Psychology Behind Dynamic Pricing

You probably are thinking that dynamic pricing is a relatively new concept and came into power only after the e-commerce boom. Well, it is not entirely true. Although it came into public notice after the e-commerce boom, its roots were deep into retail since the very beginning.

Offline retailers have long been practising dynamic pricing. They would decide on a total expense to total revenue ratio and stick between the two. (That is probably where bargaining was introduced too) This relatively old technique has adopted various techniques to get on a flexible price range but the cornerstone has always been the principle: To obtain maximum revenue.

Now: Dynamic pricing is more prominent on online platforms than their offline counterparts. The reasons are simple: The online market is more agile and is able to access your information easily. But is demand fluctuation the only reason for price variation?

You bet not.

Online portals have access to your cookie data, your location and your device details. They weigh in these factors to see how much you can shell out for their services. For example, when you check multiple websites to book a flight ticket or a hotel room, the website checks your cookies to see if you really want to book their services or if you are just browsing them. When they are sure you are going to book their services, they craft a price for you based on how many seats are left, what location you are booking from, what device you are using. This helps them determine how much you are capable of shelling out.

Now, this might seem close to personalized pricing, a technique used to handcraft prices for a loyal customer or a big client. However, it is not. Dynamic pricing techniques are based on your behaviour and demand fluctuations but it hardly hits the point of personalizing based on the client. That department is handled by personalized pricing.

Dynamic pricing takes a lot of your data into factor and determines the price that will help the vendor gain maximum profits.

The psychology boils down to simple points: If your browser history shows some expensive purchase or you are ordering from an expensive device or from an expensive locality there is a high probability that you might be paying more than the average Joe.

The Technology Behind Dynamic pricing

Now, Dynamic pricing incorporates a lot of technology to get a dynamic range of prices. Let us begin with the basics.

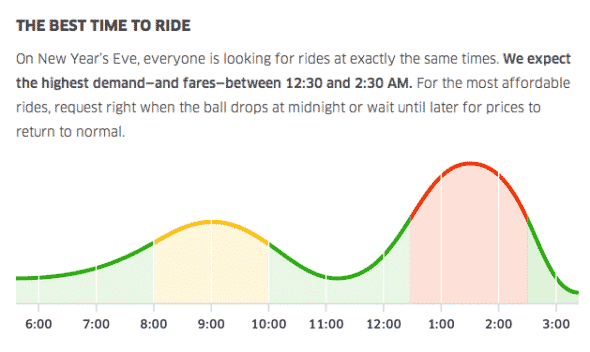

We all know the infamous dynamic surge pricing used by Uber. Now, even though the algorithm isn’t made public it is known to be fair and works on the principle of demand surge. The higher the demand: the more price you are likely going to pay. Here, is a sample plot of how surge pricing works during the New Year’s Eve:

When e-commerce websites target a prospective customer and realize that the individual has a need for a particular product but hasn’t been converted into a customer, they remarket their products. This is possible by offering decent cuts into the previous prices to convert the window shopper into a customer. How exactly do they convert customers? They use remarketing.

Here, to remarket a potential customer, the individual’s cookie data is analyzed and along with tools like Google Adwords and Facebook Pixel, a discounted price is generated that will likely entice the individual. Dynamic pricing works here, determining whether an individual would buy the product upon the change in price or not.

Many auction ecommerce stores like eBay and dealdash also use dynamic pricing to get the most out of their customers. Their special algorithms increase the price of the product with each bid made and sell it to the customer with the most unique bid.

Why Should You Go Dynamic?

In simple terms, it is the way to move forward. A rigid marketing strategy allows less to none degree of freedom and thus is unable to capture a large prospective customer base. Since the online retail market is immensely flexible and the competition is ever rising, dynamic pricing is the edge you would require to outpace your competitors.

Go On, Tell Us What You Think!

What do you think about dynamic pricing? Would you implement it in your business model or would you let it pass? Let us know in the comments.

Engineer by education. Writer by choice. I learn about new things by writing about them.