Ever wondered why H&M prices its clothes at a comparatively lower price point while a luxury brand like Louis Vuitton can charge thousands of dollars for clothes with similar materials and design?

Or why do some companies focus on offering low prices while others prioritise product differentiation?

These questions can be answered using just two elements—price and perceived value. This is where Bowman’s Strategy Clock comes in.

There’s a name to the model some brands use for competitive analysis and coming up with their business strategies – how to position their offering in the market based on price and perceived value. It’s called Bowman’s Strategy Clock.

What Is Bowman’s Strategy Clock?

Bowman’s Strategy Clock is a competitive strategy model that analyses the relationship between price and perceived value to help businesses understand and optimise their market positioning – whether for a product, brand or company.

In simple terms, the model helps businesses decide how to stand out from competitors, based on price and the value customers feel they’re getting. It shows different ways companies can position themselves, like being the cheapest, the highest quality, or somewhere in between.

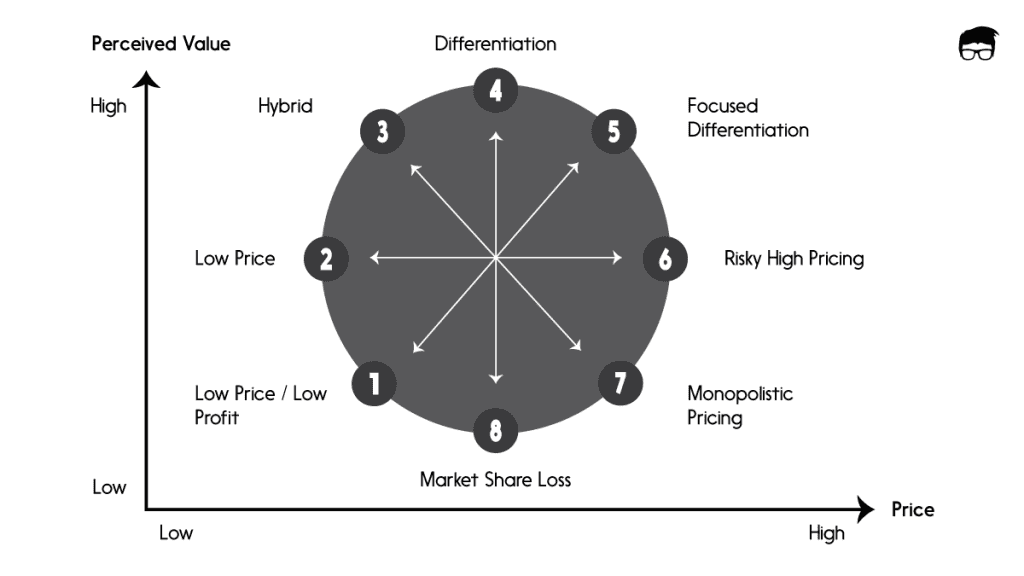

The strategy clock model is based on two dimensions – price and perceived value.

- Price: The final amount customers pay for the offering.

- Perceived Value: The perceived worth a customer assigns to the product or service based on its features, quality, branding, and reputation.

The Bowman’s strategic clock was developed by the British marketing scholars Cliff Bowman and David Faulkner in the late 1990s. It is an extension of Porter’s Generic Strategies, which focus on differentiation and cost leadership as two main strategies for businesses to gain competitive advantage.

The Eight Strategic Positions Of Bowman’s Strategic Clock

Bowman’s strategic clock is named after the shape of the model, which resembles a clock face with eight strategic positions.

The horizontal axis represents different price levels, while the vertical axis represents different levels of perceived value. This creates a clock-like structure with eight possible positions or ‘strategic options’ for businesses to consider in their competitive strategy.

Low Price/Low Value

This strategy position is known as the ‘No Frills’ approach, where companies focus on offering low prices with basic or minimal features.

It works best for cost-conscious customers who are not concerned about extra benefits.

From the business point of view, it’s typically the least competitive position and is only sustainable with high-volume sales.

An example of this strategy could be dollar stores like Dollar Tree, which sell most items for $1 or less. Only customers who are primarily driven by price will be attracted to such stores.

Low Price (Cost Leadership)

The low price strategy position is where businesses offer products or services at a lower price point than their competitors but still maintain an acceptable level or similar level of perceived value.

It’s called the “Cost Leadership” position and often works best for businesses with high-volume sales, as it requires a high turnover to maintain profitability.

It can be achieved by reducing production costs, using cheaper materials, or streamlining the distribution process.

From a target customer perspective, this strategy is suitable for price-sensitive customers who still want decent-quality products.

A good example of cost leadership or the low price strategy is Walmart, which offers competitive prices without compromising on quality.

Budget airlines like Ryanair or easyJet follow a similar strategy in the industry, offering low prices with no frills.

Hybrid (Moderate Price, Good Value)

The hybrid strategy succeeds in creating a balance between differentiation and low cost. The businesses in this position offer good value for money with moderate pricing. This gives them a competitive advantage by appealing to a larger customer base.

It targets customers who want more than just the basics but are slightly price sensitive – aiming to find a deal that’s the perfect value for money.

A good example of this strategy is Ikea, which offers affordable furniture with good design and quality.

Another example is Target, which positions itself between Walmart’s low prices and department stores’ higher prices.

Differentiation (High Value)

Differentiation results when the business sells unique features with high perceived value, allowing it to charge higher prices.

The differentiation strategy capitalises on unique features or utility that justify the higher price.

It’s about creating a value proposition that convinces customers to pay more for the product or service because of its exceptional qualities.

For example, a brand may use premium materials or craftsmanship to differentiate its products. Apple is a well-known example of this strategy, with its high-quality and innovative products. It stands out with its innovative designs, differentiated OS, and technology, and it even ensures that its customers look at it as a premium brand by using clever marketing strategies.

Another example is Tesla, whose electric cars are considered high-quality and innovative but have a higher price tag than traditional car manufacturers.

Focused Differentiation (High Value, Niche Market)

When differentiation is brought into a narrow niche market, it’s known as ‘Focused Differentiation.’ Businesses in this strategy position focus on satisfying the needs of a particular segment of customers who are willing to pay higher prices for specialised products or services.

For example, several broad CRMs in the market cater to various industries and business sizes. But if a brand comes up with a CRM dedicated to real estate agents and charges a higher price, it can still succeed because the product is tailored to meet that industry’s and target market’s unique needs.

A real-world example of this strategy is Ferrari, which caters to a niche market of luxury car enthusiasts with its high-performance, upscale cars. It differentiates itself from luxury car brands like Audi or Mercedes by targeting a specific customer segment valuing speed and performance over luxury and prestige.

Increased Price / Standard Product (Risky High Margins)

Some brands try to push their margins higher by offering unique features that justify the high price but come with high risk.

It’s known as the “Risky High Margins” position, where businesses are taking a chance on untested or new products, hoping that it would pay off in the form of high profits and growth.

An example of this strategy is luxury fashion brands like Balmain or Gucci, who often introduce new styles and trends that may not be well-received initially but can become highly popular among fashion enthusiasts later on.

Some brands like Sony do it with electronic gadgets by creating a sense of scarcity. The company initially releases new PlayStation models at a premium price due to high demand and limited availability. Prices are often lowered once early demand is met to attract a broader customer base.

When this strategy is used like what Sony does, it’s called market skimming.

Monopoly Pricing

In scenarios where the businesses are operating in a monopoly or oligopoly environment, they can set prices at a level that maximises profits.

This strategy is known as ‘Monopoly Pricing’ and requires having significant control over the market supply. It’s used by brands with a unique product or service without direct competitors.

A real-life example of this strategy is De Beers, which controls around 40% of the global diamond market and uses its position to control supply and maintain high pricing levels.

Another example is Google AdWords, where the company has a near-monopoly on online advertising and can charge premium prices for ad space due to high demand.

This position is more of an indication of failure than a competitive strategy. It’s the result when companies neither compete effectively on price nor offer sufficient value, leading to a gradual loss of market relevance and customer interest.

It often happens when companies fail to adapt to changing customer needs or technological advancements.

An example of this is Blockbuster, which failed to keep up with the rise of online streaming services and eventually went bankrupt. Another example is Kodak, which could not compete with the popularity of digital cameras and smartphones and filed for bankruptcy in 2012.

Porter’s Generic Strategies vs Bowman’s Strategic Clock

In competitive markets, businesses can either choose to compete on price or differentiate their product or service. Porter’s Generic Strategies emphasise these two approaches – cost leadership and differentiation, while Bowman’s Strategy Clock takes a more nuanced approach by considering the relationship between price and perceived value.

One key difference between the two models is that Porter’s Generic Strategies focus on having a clear and consistent strategy, while Bowman’s clock allows for flexibility in choosing different strategic positions based on market conditions.

Another difference is that Porter’s model does not consider risk as an important factor in competitive strategies, whereas Bowman’s clock includes risky high-margin and monopoly pricing options.

Aspect | Porter’s Generic Strategies | Bowman’s Strategy Clock |

|---|---|---|

Focus | Emphasises cost leadership, differentiation, and focus to dominate an industry. | Explores a broader spectrum of pricing and value options to identify optimal market positioning. |

Strategic Options | – Cost Leadership – Differentiation – Focus (either cost or differentiation focus) | – Low Price/Low Value – Low Price – Hybrid – Differentiation – Focused Differentiation – High Price/Low Value – Monopoly – Loss of Market Share |

Core Principles | – Achieving a sustainable edge by either being the lowest-cost provider or by differentiating uniquely. – Targeting broad or narrow customer segments depending on resources. | – Balancing between price and perceived value to attract different customer groups. – Offering multiple strategic options that range from cost-focused to value-focused. |

Target Market | Broad (industry-wide) or narrow (niche market), depending on the chosen strategy. | Based on the clock position, ranges from low-cost mass market to premium niche segments. |

Price & Value Relationship | Focuses on either low-cost or high-value differentiation. | Explores a combination of price and perceived value interactions, offering more nuanced positions. |

Focus Strategy | Targets a specific, narrow segment of the market, either through cost or differentiation. | Hybrid strategy on the clock aims to blend low cost and differentiation, appealing to a balanced market. |

Applicability to Product Types | Commonly used in industries where product features are clear and differentiation is feasible. | Useful across diverse industries, especially for products where perceived value varies significantly. |

How To Use Bowman’s Strategic Clock

Bowman’s Strategic Clock is a great model for businesses to evaluate their competitive strategies and come up with effective plans for future growth. Here’s a step-by-step guide on how to use the strategy clock effectively:

- Identify Your Current Position

- Analyse Competitors

- Evaluate Customer Needs and Preferences

- Choose a Target Position on the Clock

Identify Your Current Position

If your business is not a new one, start by assessing your current position on the strategy clock. Focus on the two key aspects of the clock –

- What price are you charging currently from your customers? Are those prices low, medium, or high relative to competitors

- What perceived value are you offering in return for that price? Is your product perceived as low value, standard, or high value in the eyes of your target market?

If you’re a new business with no pricing or value perception history, you can start by planning where you want to be positioned on the clock.

Once you have a clear understanding of your current position, you can move on to analyse competitors.

Analyse Competitors

Start with mapping out your key competitors on the strategy clock. Look at their pricing strategies and the perceived value they offer to customers.

Once done, notice if there’s a gap in the market that they are not filling or if there’s a position with high customer demand that isn’t saturated yet.

Also, understand why your competitors chose their current strategy. Is it due to a lack of resources or a deliberate decision? This will help you identify potential opportunities or threats in the market.

Evaluate Customer Needs and Preferences

This is key to choosing your target position on the strategy clock. Use customer data and take feedback to understand what your customers value most—low prices, unique features, brand loyalty, or premium quality.

Understand what drives your target customer to make a purchase decision and what factors are most important to them.

Additionally, take into account any changes in customer needs and preferences over time and how they might impact your chosen position.

Your end goal in this step is to find the perfect alignment between your customer needs and the value you offer.

Choose a Target Position on the Clock

Based on your analysis, identify the best position for your business on the strategy clock. Consider factors such as market conditions, competition, and brand positioning.

Here’s how you can proceed –

- If you’re focusing on cost leadership, streamline operations, reduce costs, and communicate low prices to customers.

- For differentiation, invest in innovation, quality improvements, and brand messaging that highlights what sets you apart.

- For a niche strategy, emphasise exclusivity, quality, and target-specific marketing to reach the desired audience.

Know that choosing a position does not mean limiting your options. You can always adapt to different positions on the clock as market conditions change.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.

![AI Porter’s Five Forces Analysis [Unlimited & No Login] Porter’s Five Forces Analysis Generator](https://www.feedough.com/wp-content/uploads/2024/12/Porters-Five-Forces-Analysis-Generator-150x150.webp)